[ad_1]

Authorization and capture are two of the components that make up payment processing. And though an automated solution is usually the default, in some cases it may well be necessary to use manual authorization and seize.

What’s at stake?

Receiving compensated.

As you’re about to see, in specified kinds of sales transactions, obtaining the customer’s payment is not always easy. Handling this process properly can assure you are ready to correctly receive what you are owed whilst reducing friction for buyers.

This posting will assistance you establish regardless of whether automated or guide authorization and capture is most effective for your on line business, and how to use it. Let’s get started by clarifying these terms.

What is authorization and seize?

These two distinctive occasions get position when a shopper initiates an on the net payment applying a credit score card. In most conditions, they transpire at the very same time. But they never have to, and in some conditions, you as the service provider might want to individual them dependent on the use situation.

Authorization

Authorization occurs when the payment processor contacts the cardholder’s financial institution to verify that they have sufficient revenue to go over the prices owed, and that the card is lively.

At this place, the resources have not yet transferred from the customer’s financial institution to the small business, but they are, in essence, reserved for that goal.

Authorizations are short-term. Generally, they expire just after seven days, which suggests no funds alterations fingers if the capture system doesn’t start off before expiration.

Seize

Capture, also known as the settlement of the payment, happens when the money actually variations hands in between the customer’s bank and the merchant. Your financial institution instructs the payment processor to gather cash from the customer’s lender and transfer them to your account.

Where do authorization and seize sit inside the payment approach?

These procedures normally get started straight away following the customer clicks the button to make a payment for their order. This is true regardless of whether you use WooCommerce Payments or any other payment processor.

By default, these two procedures happen at the exact time, and which is best for most organizations. But for sure use circumstances, as you’re about to see, it’s important to different them into unique activities.

Handbook vs. automated authorization and capture

Ahead of we glance at separating them, let’s be certain you recognize your options.

When authorization and capture occur at the similar time, they’ll constantly be automated.

But if you want to different them into two distinct gatherings, you can make the capture course of action manual. In that condition, you would have to go into your payment processor and manually initiate the seize procedure. For WooCommerce Payments, you can enable this inside the admin configurations.

When is manual seize handy?

Let’s search at some scenarios to support you see when utilizing a manual capture approach may well be a wise method for your small business.

Fuel or petrol

When you fill up your gas tank, the authorization procedure happens just before you have pumped any fuel. The fuel company authorizes your card and then allows you to pump, but it does not seize the rates nevertheless because it doesn’t know how a great deal fuel you will acquire.

Accommodations

In most lodge transactions, the guest’s card gets authorized just before or at verify-in for an estimated amount centered on the range of days they’ve reserved the place. But the capture procedure ordinarily comes about at checkout, when the genuine sum owed is recognised.

Tools rental businesses

In particular with highly-priced products, most firms will authorize the customer’s card ahead of giving them the product to be rented. This makes certain they can deal with the costs. Some businesses authorize payment for the precise worth of the product, not just the rental payment, in scenario it will get ruined or stolen. Then, when the merchandise is returned, the true volume to be billed is captured.

Artisans

Several artisans do custom get the job done and their price ranges change from position to work. Oftentimes, the closing sum to be charged isn’t known until eventually the function is finished, especially if the labor is billed by the hour. From time to time they may perhaps want to authorize and seize part of the cost up front, and then do the rest after the career is finish.

With these examples in head, you can begin to imagine eventualities in your have organization when separating seize from authorization may be needed.

If you’re just filling on the net orders for items and then shipping them, you ordinarily will not will need to independent authorization and seize. But any time the final amount of money of payment is not acknowledged up front or the product or service is transported at a later on day, you may perhaps have to have to authorize payment 1st, but not essentially capture it at the exact time.

Guide seize drawbacks

There are some dangers with manual capture. Let us review a number of matters to check out out for.

Initially, you just can’t seize extra than the amount you authorize. You can only capture the identical or much less. So if you’re not absolutely sure about the final rate, authorizing up front places you at hazard of undercharging. So you’d have to make a second demand, or terminate the very first 1 and restart the method with the higher quantity. Neither choice will possible make the shopper happy.

2nd, the authorization expires after 7 times. So, in cases with lengthier wait around instances between purchase placement and get fulfillment, if you wait to capture payment until the purchase is fulfilled, you run the risk of the transfer being declined. In that circumstance, you may possibly discover on your own having transported the item but unable to accumulate the money.

Now, you are going to have to speak to the consumer to restart the payment course of action yet again.

This is why, until you have a excellent rationale to separate authorization from seize and understand the pitfalls of accomplishing so, you should not do it.

Lastly, guide capture is only possible with card payments, not neighborhood payment approaches or apps like Venmo.

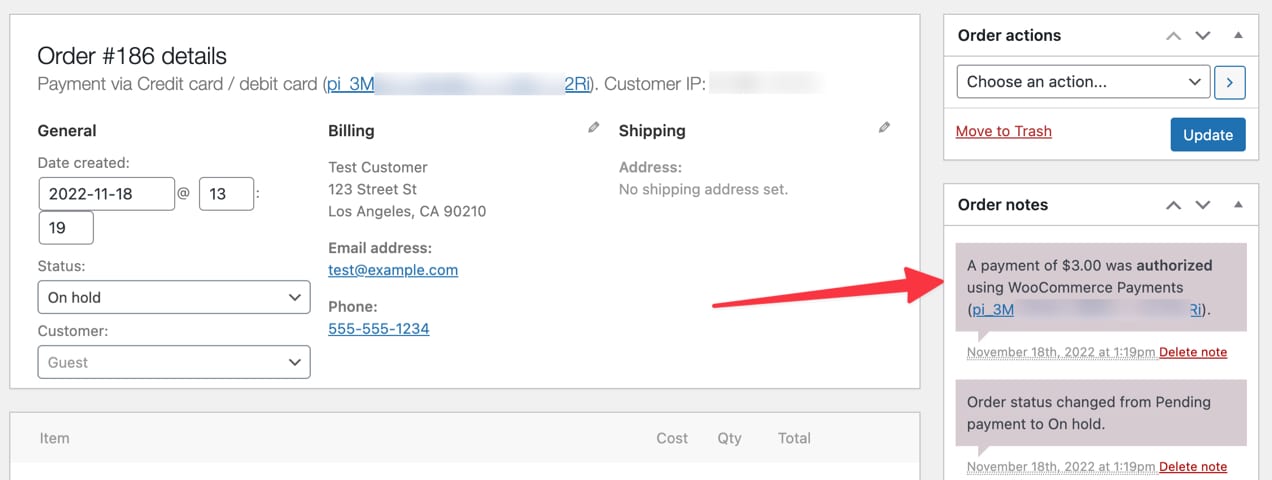

Bettering handbook authorization and seize in WooCommerce Payments

Try to remember, you can seize considerably less than you authorize, but not a lot more. If you’re performing the approach manually, you will have to manage this within your payment processor.

Which is one particular reason why WooCommerce Payments is simplifying the handbook authorization and seize approach. Here’s a full consumer information for how to handle authorization and seize in WooCommerce Payments.

Finest procedures for managing handbook authorization and seize

Below are a handful of important recommendations to don’t forget when applying the manual procedure.

1. Really don’t use manual authorization and seize without the need of a fantastic motive

This adds friction to your website, boosts your workload, and puts you at danger of some of the situations explained above. If you have a very good rationale to use handbook seize, then you just need to have to keep on best of it and you’ll be good.

2. Authorize much more than you could need to seize

As outlined, you can seize fewer or the identical volume, but not more than you authorize. So if the remaining payment quantity isn’t recognised at the time of invest in, authorize a larger amount than you imagine you will stop up charging.

3. Do not hold out to terminate authorization of canceled orders

If the purchaser cancels their purchase, really do not wait around 7 days for the authorization to expire. Cancel it right away.

4. Look at your payments dashboard on a regular basis

In particular in better transaction enterprises, you don’t want to overlook capturing any payment if you’re utilizing the guide solution. So check your dashboard regularly. Applying manual authorization and seize implies you have to construct this stage into your plan.

And once again, if you are utilizing WooCommerce Payments, refer to this tutorial for how to set up and control the authorization and capture actions in the payment system.

WooCommerce Payments: streamlined versatility for your store

A important gain of WooCommerce is your skill to hook up to the systems that very best fit your keep. When it comes to getting paid, much more merchants than at any time are turning to WooCommerce Payments for its simplicity of use and adaptability.

You can take payments in 18 nations and accept a lot more than 135 currencies. Enable shoppers to use electronic wallets like Apple Shell out, reducing friction and boosting conversions. And several merchants can complete transactions on the go with the WooCommerce Mobile App and card reader.

WooCommerce Payments integrates completely with your store’s dashboard so you can regulate all the things in a single location. No extra swapping tabs and logging in and out of accounts. Moreover, it’s designed and backed by the WooCommerce group and will come with precedence help.

[ad_2]

Source backlink