[ad_1]

Shopify Payments vs Stripe: Which solution should you really be using for your ecommerce store?

Both Shopify Payments and Stripe offer very similar services to business owners. Both allow you to accept and process payments online, ensuring your ecommerce company can make a profit. In fact, Shopify Payments is actually powered by Stripe technology, so you can rest assured both tools will give you the same level of security, and efficiency for payment processing.

However, despite similar underlying tech, Stripe and Shopify Payments do come with some distinct differences. We created this complete guide to the features, pricing, and pros and cons of each service, to help you make the right choice for your company.

What is Shopify Payments? The Basics

Most people are familiar with Shopify, the world-renowned ecommerce platform designed to help companies produce websites, manage inventory, and run their business in an all-in-one environment. Shopify Payments is the native solution built into this platform, which allows retailers to accept and process payments from customer credit cards and debit cards.

Included with every Shopify plan, Shopify Payments eliminates the need to set up a third-party payment provider solution or merchant account when you develop your online store. As soon as you create your site with Shopify, you’ll be able to automatically accept all major payment methods, provided you’re located in an approved country or region.

To use Shopify Payments, you’ll need to secure your account with two-factor authentication, and follow the instructions provided by Shopify. Fortunately, the process is extremely straightforward, and for Shopify store owners, it can also be the best way to keep operating costs low. When you use Shopify Payments on your Shopify store, you won’t have to pay third-party transaction fees.

The zero-transaction fee benefit extends to PayPal Express, Shop Pay, and Shop Pay Instalments. Plus, you won’t have to pay fees on manual payment methods such as cash and bank transfers.

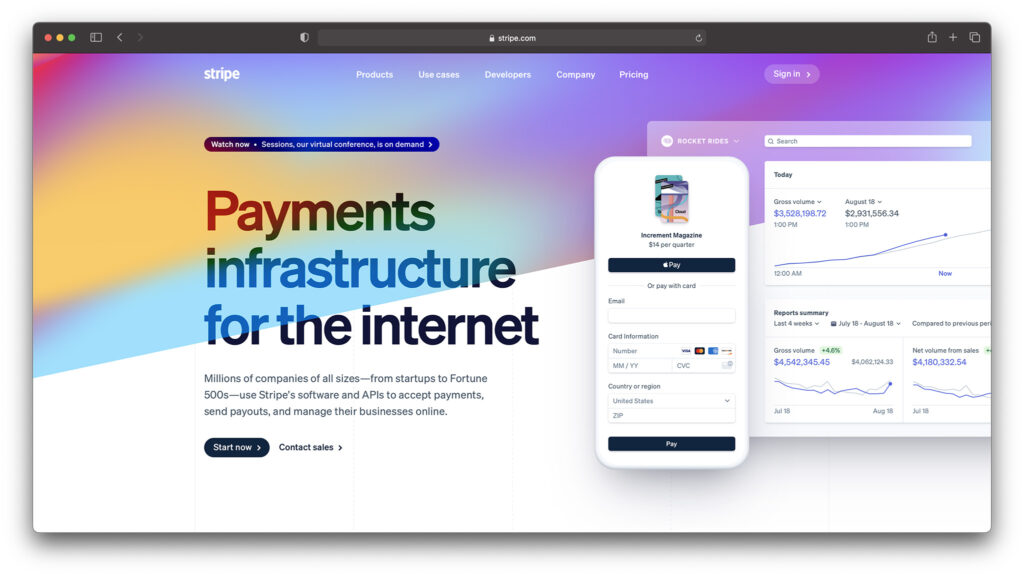

What is Stripe? An Introduction

Stripe is a comprehensive payments platform, and Irish-American financial services company, located in California, within the United States. This SCA-accredited payment solution helps businesses of all sizes to accept payments, send pay-outs, and manage finances online.

Stripe enables global payments for online retailers, with access to a huge variety of valuable tools, from invoicing, to billing and subscription management, and payment links. Companies can even use Stripe to create their own unique payments pages, boost security with fraud and risk management, and even utilize online identity verification.

Similar to Shopify Payments, Stripe accepts a host of payment types, from credit card and debit card transactions to offline payments processed through point-of-sale (POS) systems and terminals. Stripe is also a highly flexible tool, with APIs for developers, app-building solutions, and pre-built integrations, designed to give teams access to secure payment processing, faster.

The Stripe platform is dedicated to fast innovation, making hundreds of improvements to its technology every year. Plus, the systems managed by Stripe promise a 99.99% uptime, so companies don’t have to worry about missing out on transactions.

Stripe Features Overview

Compared to Shopify Payments, which focuses exclusively on payment processing for the Shopify ecommerce platform, Stripe is a more comprehensive and flexible solution. The payment service provider allows businesses to accept various payment methods, from digital wallet transactions to ACH payments, and credit and debit card payments.

Stripe offers a host of pre-built and customizable payment solutions. The products offered by the company break down into three sections:

- Global payments: Online payment processing, checkout management, customizable payment UIs, payment links, fraud and risk management, and payment platform connectors. Global Payment services also include subscription and billing management tools, online invoices, terminal solutions, financial connections, and online identity verification.

- Revenue and Finance automation: Custom reporting tools (Sigma), data pipelines, startup incorporation (Atlas) revenue recognition, tax and VAT automation, invoicing, and billing.

- Banking as a service: A comprehensive range of card creation and connection tools for financial companies.

For ecommerce businesses, the most valuable features exist in the Global Payments ecosystem. With Stripe, you can accept payment methods including:

- Credit and debit cards: Mastercard, Visa, American Express, Discover, etc.

- Digital wallets: Google Pay, Apple Pay, Microsoft Pay, etc

- ACH debit, ACH Credit and wire transfers

- Buy now pay later services: Klarna and Afterpay

- Local and international offline payments

Stripe is available in more than 30 countries, with payment processing available in over 135 currencies. It can also be implemented into your business strategy in a range of different ways. Many ecommerce store builders, such as Shopify and WooCommerce, come with native integrations with Stripe already. Plus, companies can use pre-built integrations to connect their site to Stripe, bill customers with online invoices and shared links, and use Stripe Terminal for POS transactions.

Shopify Payments Features Overview

As mentioned above, Shopify Payments is built on top of Stripe technology, although the functionality offered is a little different. Shopify Payments comes included with all Shopify plans, and it’s the only way for ecommerce companies to accept payments on Shopify, without paying third-party transaction fees.

The Shopify Payments payment gateway allows businesses to process payments both online and in-person, through Shopify stores, or the Shopify POS tools. The solution integrates with over 100 payment providers, and is available in 22 countries, with more than 130 currencies to choose from. Accepting payments with Shopify Payments is quick and simple, and the solution supports many of the most common payment options, such as:

- Credit and debit cards: Mastercard, Visa, American Express, Discover, etc.

- Digital wallets: Google Pay, Apple Pay, Microsoft Pay, etc

- Online payment tools like PayPal

- Local and international payment methods

- Manual payments with card reader tools, and terminals

Both Shopify Payments and Stripe are both PCI compliant, and secured with fraud protection tools, fraud filters, and other resources to help protect business leaders from issues. Unlike Stripe, however, Shopify doesn’t offer as many implementation options. The solution is only intended for use by Shopify store owners. The solution comes integrated with Shopify, and can be used with:

- Your standard Shopify checkout page

- Shopify purchase links

- Social media sales channels integrated with Shopify

- Shopify approved card readers, terminals and POS tools

Shopify Payments vs Stripe: Ease of Use

Both Shopify Payments and Stripe are legitimate, reliable tools for payment processing. Whether you’re a small business or a growing enterprise, you can use these tools to rapidly transfer funds from customers to your bank account, with minimal effort.

To get started with Stripe, all you need to do is sign up for a free account on the Stripe website. You don’t need to enter banking details to create an account, but you will need to provide these details if you want to transfer money to your bank. The payouts available from Stripe are pretty fast too. The system works on an automatic daily payout schedule, and gives businesses the option to switch to a weekly, or monthly schedule if they prefer.

Funds are usually available from Stripe online and in-person payments within 2 days after processing, but timing can vary based on your bank and location.

Using Shopify Payments requires you to have a Shopify account. You’ll need to sign up for a monthly subscription with the ecommerce website building service to start accepting payments, but there’s no fee for using the Payments solution itself.

Once you have a Shopify store, you can activate your Shopify Payments account instantly, or implement other payment processing solutions if you prefer. However, using an external payment processor on Shopify means you could incur extra processing fees.

Shopify sends funds to your bank within two business days of a transaction, and you can also set payouts for a weekly or monthly schedule.

Shopify Payments vs Stripe: Fees and Processing

Most payment processing tools do come with some fees to consider. Fortunately, both Shopify and Stripe are relatively transparent with their pricing structures. With Stripe, you’ll pay nothing for a standard Connect account, but you may pay either $2 per month for Stripe Express (used by marketplaces), or Stripe Custom (white label payment processing).

Payment processing fees for Stripe are relatively standard. In the US, you can expect the following:

- Online transactions: 2.9% plus 30 cents

- In-person transactions: 2.7% plus 5 cents

- Manual transactions: 3.4% plus 30 cents

- Currency conversion: 3.9% plus 30 cents

There are also some additional fees to consider too, such as a $15 chargeback fee, additional 1% fees for international cards, and add-on fees for Stripe services like chargeback protection, identity verification, premium support, and so on.

Shopify Payment’s fees can be a little more complicated because they vary depending on the Shopify plan you choose. The core Shopify Plans and their associated fees include:

- Shopify Basic: $29 per month for Shopify, and 2.9% plus 30 cents for online payments, or 2.7% for in-person transactions.

- Shopify: $79 per month for the ecommerce platform, then 2.6% plus 30 cents for online payments, or 2.5% for in-person payments.

- Shopify Advanced: $299 per month for the ecommerce plan, then 2.4% plus 30 cents for online transactions, or 2.4% for in-person payments.

Shopify Plus plans, starting at $2000 per month, come with the lowest rates of any plan, and are charged depending on your location.

Notably, if you use a anything beyond Shopify Payments for your Shopify store, an extra 2%, 1% or 0.5% transaction fee is added to all of your costs, depending on your plan. Shopify Payments also has a $15 chargeback fee, and a 1% cross-border fee on sales made with a credit card issued in other countries for businesses in the US.

Shopify Payments vs Stripe: Pros and Cons

On the surface, Shopify Payments and Stripe have a lot of similarities. They’re both secure solutions for payment and credit card processing, ideal for online businesses and offline retailers alike. However, Shopify Payments is a far more focused solution, designed specifically for users of the Shopify platform. Alternatively, anyone can utilize a Stripe account, regardless of what kind of website builder or tools they’re using.

Let’s take a closer look at the Stripe and Shopify Payments Pros and Cons.

Stripe Pros and Cons

Pros ?

- Wide range of payment methods: Stripe accepts a wide variety of payment methods, from credit and debit cards to bank payments, buy-now-pay-later options and more.

- Excellent reputation: Stripe has a fantastic reputation in the payment processing market, and a global reach. It’s available in more than 30 countries worldwide.

- Simple pricing: Although local payment processing fees can vary with Stripe, the pricing structure used by the company is relatively straightforward.

- Customization: Stripe is a highly customizable solution, with tons of tools to explore, including pre-built checkout forms, integrations, and APIs.

- Customer support: Stripe delivers excellent 24/7 customer support through chat, email, and phone. Plus, there’s a developer community for extra technical guidance.

Cons ?

- Some features require technical knowledge: If you don’t have a lot of developer knowledge, you might struggle to take full advantage of Stripe’s customization options.

- Limited in-person payments: While you can take in-person payments with Stripe terminal, the payment processing solution is best suited to those with an online business.

Shopify Payments Pros and Cons

Pros ?

- Automated integration with Shopify: Shopify Payments comes automatically integrated into every Shopify store, regardless of your monthly plan.

- Low costs: If you’re already using Shopify for ecommerce, utilizing Shopify Payments can help you keep your monthly costs as low as possible.

- Excellent security: Like Stripe, Shopify offers excellent security and fraud protection for payment processing, so you and your customers can rest easy.

- Customer support: Shopify includes access to 24/7 support on all of its plans, with email and live chat. Plus, there are packages available with phone support too.

- Ease of use: Shopify Payments is easy to setup and leverage. You can activate your account and start customizing your payment strategy in minutes.

Cons ?

- Reduced availability: Shopify Payments is only available for Shopify users, and it’s limited to fewer countries and regions than the Stripe platform.

- Extra fees: To use Shopify Payments, you’ll need a Shopify account. Additionally, if you don’t use Shopify payments, you’ll be subject to higher processing fees for your store.

Shopify Payments vs Stripe: Which Should You Choose?

If you’re looking for an excellent payment processor for your online store, Shopify Payments and Stripe are both excellent options. While there are a few key differences between the two tools, they both offer flexible, secure, and convenient payment processing for all kinds of brands.

Primarily, Shopify Payments is likely to be the best option for you if you’re already the Shopify platform to build your online store. It can help to cut down the subscription fee and monthly fees for your Shopify site, by eliminating extra transaction costs.

On the other hand, if you’re looking for something a little more flexible and customizable, the Stripe ecosystem can work with a variety of store builders and marketplace tools.

[ad_2]

Source link

![How to make Cartoon videos? [With Talking Characters]](https://wildfireconcepts-media.sfo3.digitaloceanspaces.com/2022/10/Cartoon-videos-Blog-copy_1170x500-440x264.png)