[ad_1]

Why let data get in the way of a good narrative?

Tech stacks are going to shrink dramatically. Marketing’s tech stack is bloated compared to every other department. Shadow IT is a scourge across major martech systems. And most SaaS products — especially martech apps — are highly underutilized, a wanton waste of resources.

It’s enough to make you shake your fist in the air. “Down with martech! Down with SaaS!”

The only problem with those cathartic rants? They’re not true.

Or, more accurately, the latest data from Productiv’s 2023 State of SaaS report doesn’t support those claims. On the contrary, it mostly refutes them.

Productiv is a SaaS intelligence platform that helps companies manage their tech stack. For this report, they analyzed over 100 billion app usage data points across nearly 100 million SaaS licenses managed through their platform over the past 3 years. So the basis for their report is empirical data, not unreliable survey answers. And it’s a pretty significant pool of data to draw meaningful analyses from.

So what does their data say about these popular “myths” of martech madness?

Myth #1: Tech stacks are shrinking dramatically

Nope.

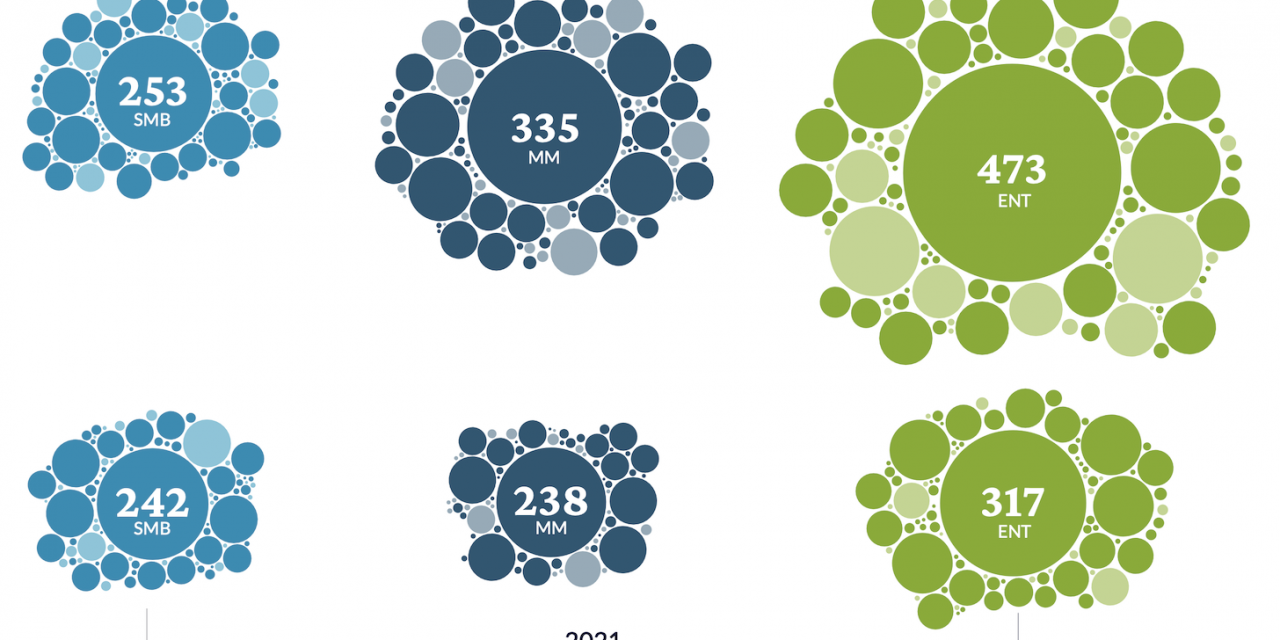

As you can see from the graphic at the top of this post, SaaS tech stacks haven’t shrunk significantly. In fact, the average SaaS stack grew 32% over the past two years.

However, that doesn’t mean there hasn’t been some “rationalization” in tech stacks:

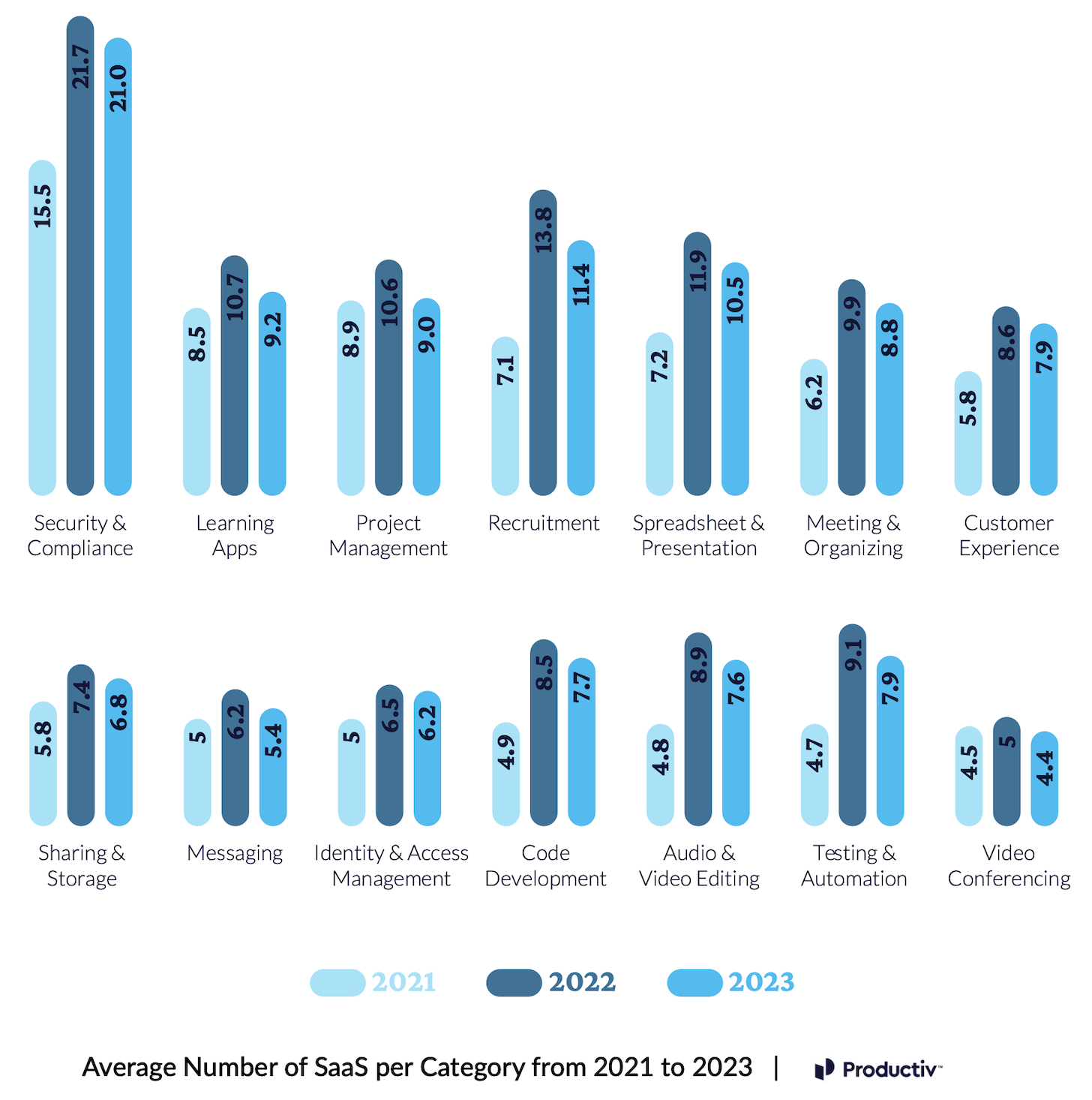

You can see that after peaking in 2022, most categories of apps in company tech stacks started to reduce the number of different products they were using. Granted, this was after a much larger jump in app diversity from 2021 to 2022.

Such rationalization of tech stacks is good, clean living, and I’m all for it. But it hasn’t made a significant dent in the total size of stacks.

Will this consolidation trend continue? Possibly. The challenge in predicting these things is that it’s the tech stack equivalent of the three-body problem. While there are strong forces in the market and in IT that work to reduce the number of apps, a continually changing tech landscape — hello, AI — keeps spinning up new products that companies eagerly adopt to stay competitive.

Anyone who claims they know, with absolute certainty, how that will net out in the next few years is delusional. Or maybe with the benefit of being Fooled by Randomness, prophetic.

For me, empircal data remains the arbiter of such debates. And this data unequivocally says that, as of today, tech stacks have not shrunk dramatically.

Myth #2: Marketing has the largest tech stack

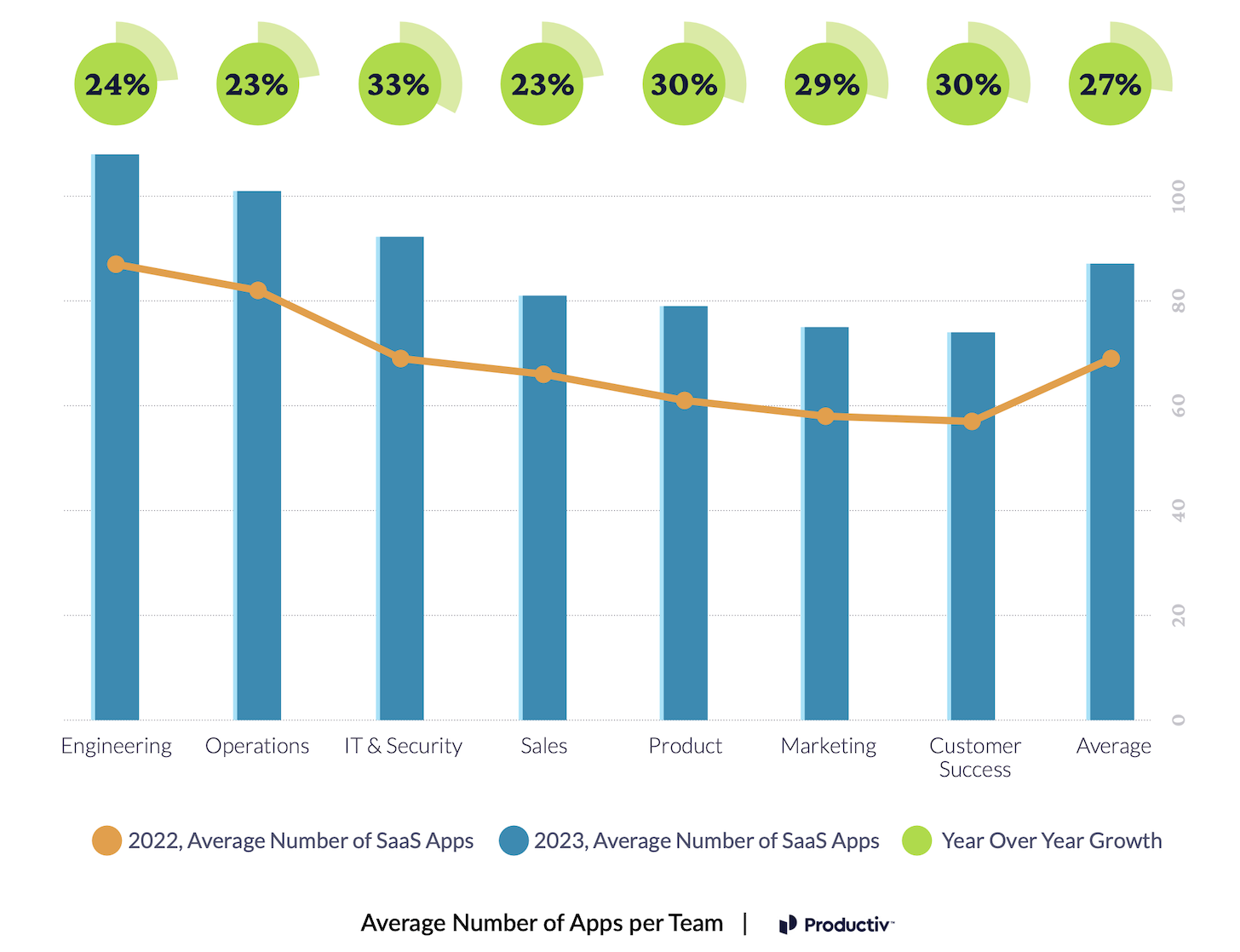

No, actually, marketing has the second smallest tech stack.

Granted, an average of ~75 apps being used within marketing — note, this count includes apps used across multiple departments — isn’t exactly small. But it’s below the company-wide average of 83, and well below the 100+ apps used on average by engineering and operations teams.

I can’t help but note wryly that IT & security teams use more apps than marketing, sales, or customer success teams. And in the chart of app categories that we looked at earlier, it’s Security & Compliance that pops with nearly twice as much diversity of apps compared to any other category. Who’s guarding the guardians of SaaS sprawl?

As Alanis sang, “Isn’t it ironic, don’t you think?”

Myth #3: Shadow IT is a terrible scourge in martech

“Shadow IT” is the label used for software apps that business users adopt without express permission from IT. Other things being equal, I’m against it — as most rational ops people I know are. For security reasons, compliance reasons, financial reasons, support reasons, and more, it’s a wise idea for the IT department to have visibility and governance across the apps employees use.

So when you hear that 51% of SaaS apps are identified as shadow IT — the stat cited in Productiv’s report — it’s easy to get the impression that major systems are rampantly out of control. And, of course, marketing and martech are assumed suspects for such shadowy SaaS skullduggery.

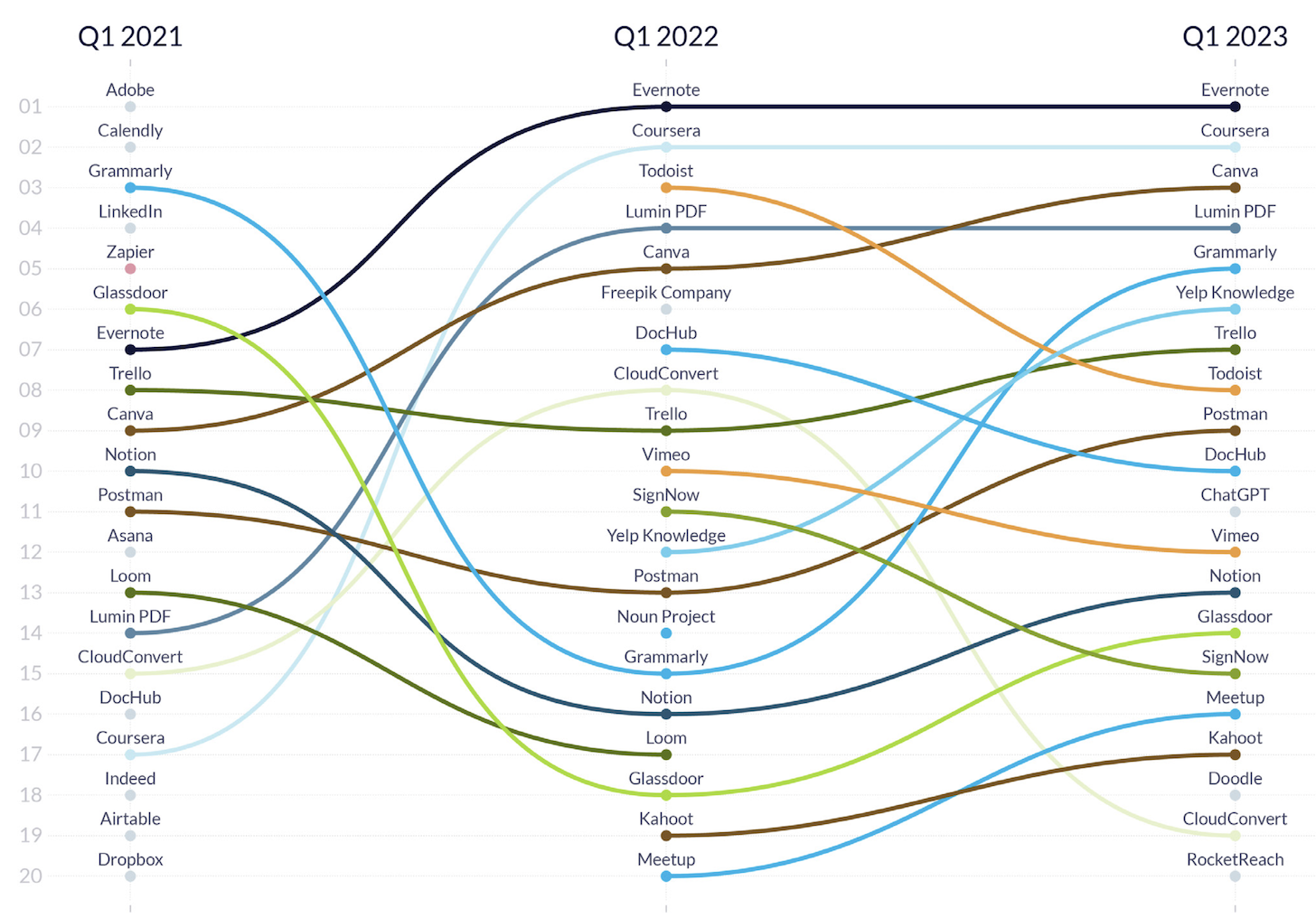

But Productiv double-clicked on that stat to reveal the top 20 apps that contribute to this shadow IT scourge:

Hmmm. Coursera? Grammarly? Glassdoor? Todoist? Doodle? Meetup?

I’m not saying there’s zero downside to people using these products outside the watchful eye of IT. But a marketing manager using Canva to generate a few graphics to promote a get-together on Meetup doesn’t seem like a four-alarm crisis. Frankly, the line between “app” and “website” seems blurry here. ChatGPT is an app, but Bing and Google Search with Bard enabled are websites?

Yes, these shadow IT apps should be brought out of the shadows.

But looking through this list puts things in perspective. Especially since anything that you would consider to be a core part of a martech or salestech stack is nowhere to be found here.

Myth #4: Most SaaS is terribly underutilized

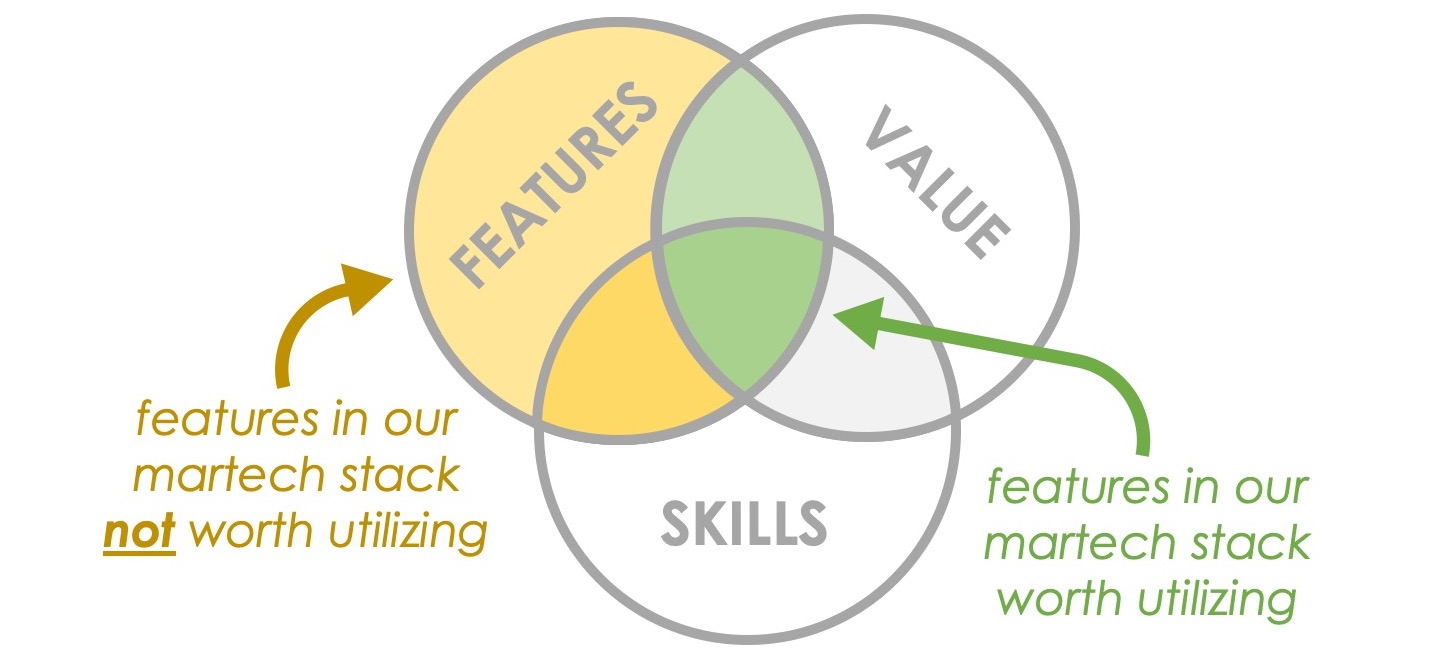

I’ve long argued that utilization is often a misguided metric in martech.

When talking about a specific product, it makes little sense to measure utilization by how many of its features you use. Most apps have a ton and are constantly adding more. Use the ones that matter for your business. Don’t feel compelled to use the rest. They’re not “wasted” just because you don’t use them. Software doesn’t work that way.

A more reasonable measure of utilization is whether the app is being used at all. Or, more commonly, if you have multiple “seat” licenses for a product at your company, how many of those are being regularly used by the people they’re allocated to?

This is the measurement that Productiv reports: how many SaaS seat licenses have had any usage within a 90 day period? Their answer: on average 47% in 2023. Which is pretty shocking! 53% of a company’s SaaS licenses aren’t being used regularly?!

The obvious move would be to cut half your licenses and — implied — halve your costs.

But sniff test: something doesn’t smell quite right about that. That seems like an awfully big number for so many companies to have been blind to for so many years.

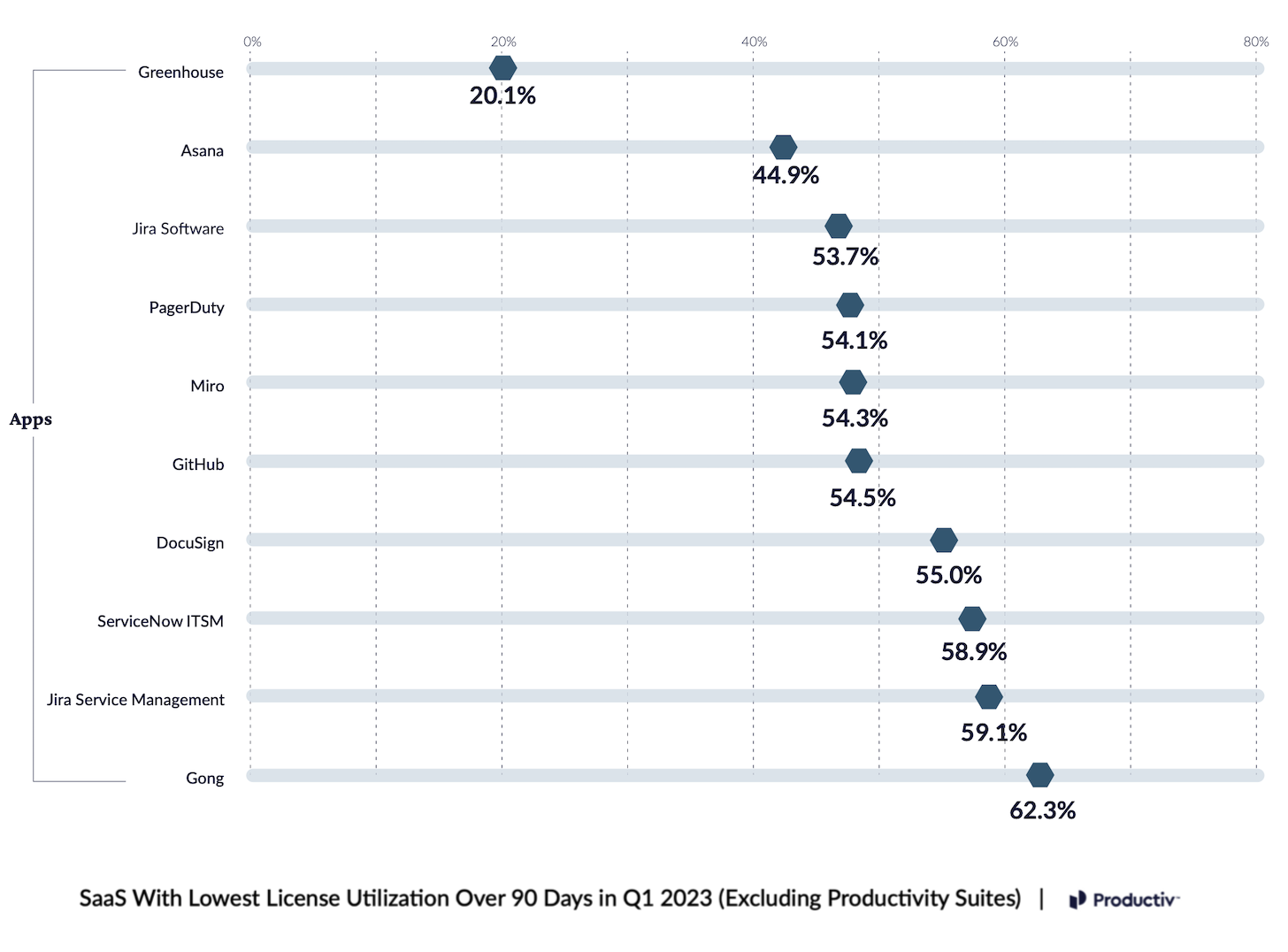

Once again, Productiv sheds some light on what’s really happening by listing the top 10 apps with the lowest utilization rates in Q1 2023:

First, I’d point out that no martech app is in the top 10.

But more importantly, the “worst” offender on this list — Greenhouse, which has only a 20.1% utilization rate — reveals a more rational explanation for so-called underutilization.

Greenhouse is an applicant tracking and hiring platform. Naturally, it’s used regularly by anyone in recruiting and perhaps with reasonable frequency elsewhere in HR. But to be effective, everyone else in the company who is ever involved with hiring people — hiring managers but also anyone who even once interviews a candidate — also needs to use it. That’s a lot of people. But most of them are involved in hiring only occasionally, perhaps rarely.

As result, probably most Greenhouse users don’t utilize the app in a 90 day window.

That’s not an aberration, and it’s not “waste.” That’s how the software is designed to be used. And while I don’t know the details of Greenhouse’s pricing and packaging, I’m sure that’s reflected in what they charge. Because the ATS space — like every other SaaS category — is insanely competitive. If Greenhouse were to massively overcharge, they would get eaten by a more fairly-priced alternative. Switching costs on an ATS aren’t that big of a barrier.

You see this same dynamic with other “offenders” on this top 10 list too.

DocuSign? Legal and procurement might need to sign things frequently. But many more people in the company need to sign things only once in a while, maybe a long while. 55% regular utilization seems pretty impressive when you think about it.

ServiceNow? If that’s used for IT service management, then IT staff are probably regular users. The rest of the company only occasionally utilizes the product when they need to request a service from IT. So here too, 58.9% utilization seems about right. You could argue that most companies would want lower utilization, as it would mean fewer requests for the IT department.

The point is that you can’t just ditch all these “underutilized” Greenhouse, DocuSign, or ServiceNow licenses without breaking the fundamental value they provide. They actually are being utilized in the exact way they’re intended to.

Products such as Asana, Jira, Miro, etc., are a little different. In theory, you can imagine how they could — should? — be used by most people most of the time. But in practice, especially in a larger company, that’s not what happens. Some teams or individuals within teams use those products a lot. Others not so much. But the option to access an Asana, Jira, or Miro board when necessary is valuable to non-frequent users.

There is a more plausible argument that such underutilized licenses are wasted.

But even then, the reality of SaaS purchasing compensates for this. When companies negotiate for enterprise-wide licenses to such popular-but-not-universally-used apps, this utilization is factored into the discounted price they pay. While there may be a number of “seats” allocated in such a deal, it’s really more of a fixed-priced bundle: get access for your entire company for $X. You can divide $X by your number of employees n, but it’s somehwat of an artificial number. All that really matters is whether it’s worth $X for you to have that capability company-wide. If it is, buy it. If it isn’t, don’t.

There’s no physical waste here at all. You’re simply paying for a set of employees to use the product regularly and for the rest of your employees to have the option to use the product occasionally — and maybe even be converted to using it regularly.

Anyway, this isn’t to say that you shouldn’t work to reduce truly underutilized apps from your tech stack. SaaS management platforms such as Productiv are super valuable for helping to eliminate redundant and unused apps. And they can be very helpful tools in negotiating fees for “underutilized” — i.e., occasionally used — apps.

But the notion that the vast majority of SaaS is truly underutilized is a myth — even if it makes a great narrative to rant about.

[ad_2]

Source link

![Is Light in the Box Legit? [Find Out Here and You Won’t be Sorry in 2022 ]](https://wildfireconcepts-media.sfo3.digitaloceanspaces.com/2022/10/lib-440x264.png)