[ad_1]

Running an online business has its challenges, and sustaining cash flow is vital.

In simple terms, cash flow is the net amount of cash and equivalents transferred in and out of a company. How well you track and maintain it can make or break your business’s growth.

For example, VO2, a custom performance sports-clothing brand, even after making £250k a year, failed solely because of mismanagement in cash flow.

Online businesses need a firm grasp of their cash flow and a solid strategy to improve it. However, it involves several elements, posing roadblocks for budding e-commerce companies.

To help you understand the ins and outs, here is a guide on how to build a healthy cash flow that grows and sustains your business.

How To Build A Strong eCommerce Cash Flow Strategy

A healthy cash flow helps eCommerce brands to seize opportunities and explore untapped areas of their industry without worrying about budgets. It lets you keep up with your financial obligations and plan future goals.

Let’s dive into how you can build a solid cash flow strategy for your online business.

1. Assess the current cash flow situation.

First, you must understand your company’s current cash flow situation to keep the money flowing. Here are some things you can do to get insights.

Understanding Your Revenue and Expenses

The first step to creating a cash flow statement is measuring your net revenue.

You understand how money flows through your business by keeping track of your regular revenue.

Your net revenue is your business’s total income in a period, excluding expenses, taxes, and owed interest.

Start by calculating all the income your business generates in a period. This should include revenue from services rendered or goods sold and the money you bring from investments or assets.

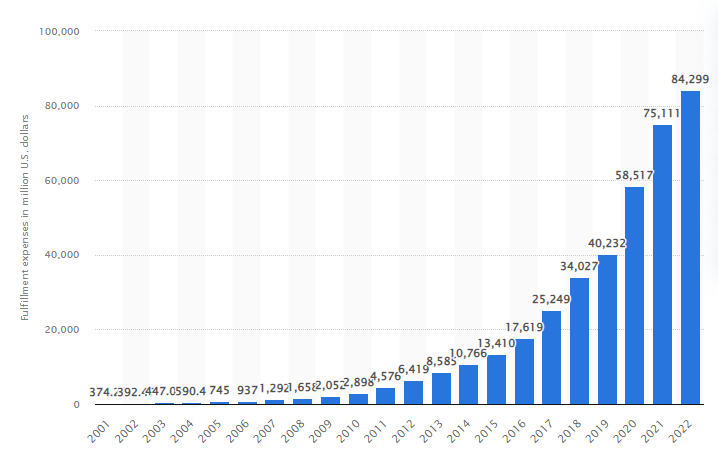

Source: Statista

For example, Procter and Gamble’s operating cash flow shows a wavering graph from 2012 to 2022.

Your total business expenses are another aspect of assessing your current cash flow. Tally up your inventory purchases, payables, and deferred revenue for ongoing and upcoming projects. Calculate other liabilities like fixed asset depreciation and income tax expenses.

For example, Amazon’s fulfillment expenses have steadily increased between 2021 and 2022. In their recently reported fiscal year, Amazon’s fulfillment expenses amounted to $84.2 billion, a whopping increase from the previous year’s $75.1 billion.

Conducting a Cash Flow Analysis

Now that you have a clear cash flow statement, it’s time to analyze it. Here’s how:

- Identify the limited cash reserves.

- Assess which payments are frequently delayed and why.

- Check for excessive inventory.

- Consider seasonal demand.

- Segment operational, financing, and investment activities.

- Examine your cash runway.

Identifying Potential Cash Flow Issues

Identifying deficits becomes easier once you logically lay down the inflows and outflows of money. Tracking when your business receives money helps you pinpoint where you overestimated the cash flow.

For example, if you see a sizeable due payment in certain months, it shows the need to adjust your business model.

You may notice a yearly deficit that has increased in the same month. This can be an underlying issue with your sales process.

2. Create a cash flow forecast.

Cash flow forecasting helps companies see any upcoming deficits in finances and prepare ahead of time. It also helps when planning expansions and recruiting new staff, increasing the overall efficiency of the eCommerce business.

Start by deciding how far ahead you should calculate the forecasting. This can cover anything from a few weeks to months. Consider your resources and plan accordingly. If you are a new business, audit your data and see if you have enough insights to forecast the cash flow of your target period.

The next step is listing all your income in that specific period. Start with sales and organize them accordingly. For example, you can create one column for each week or month and one row for each type of income. Creating an accurate sales projection for your chosen period is also crucial.

Other incomes you need to consider include:

- Royalties or license fees

- Grants

- Tax refunds

- Investments

List all your cash outflows as well, including:

- Asset expenses

- Raw material

- Rent

- Fees and charges

- Bank loans

- Taxes

- Marketing expenditures

Collect all the above numbers of your current and previous business periods and compare them to identify changes. If you plan any new business strategy, include the projected result in your calculation.

The process involves several crucial aspects. Conducting it manually may render the forecasting inaccurate or inconclusive.

Opt for automation software for your cash flow forecasting to save time and ensure precision.

You must also regularly review the cash flow forecast to identify even the most minor changes. This will help you keep the forecasting accurate and effective throughout the decided period.

3. Build a strong cash flow strategy.

The next step is to create a meticulous strategy to increase cash flow and protect your scaling eCommerce business. It involves eliminating underlying issues, setting achievable goals, building a step-by-step process to increase revenue, reducing expenditure, and accounting for unforeseen changes.

A thorough assessment of your cash flow will help you identify issues. Segment these problems between departments. It will help you tackle each segment with accuracy.

Set up realistic targets for your cash flow enhancement strategy. This helps you optimize your resources and get the best possible result.

Now you can develop a plan to increase cash flow. Plan your inventory based on past sales, forecasting, and seasonal demands. This way, you will avoid spending too much on stocks and have enough to meet demand.

If you have higher-margin products, consider arranging payment terms with your vendors so that you can pay later. You can also reduce your order size to spread out your payments. This approach is practical if your shipping costs are low and the price point doesn’t align with purchase scaling.

Identify expenses and come up with a proper plan to reduce them. Are you renting out spaces you rarely use but are essential for your seasonal operations? While building a cash flow strategy, see how to replace that expense with a more functional one.

You must also plan to optimize the average order value of your eCommerce business to minimize any risks while forecasting. This will bring more cash into your business, enhancing your cash flow. It will also lower your customer acquisition cost and overall marketing expenses as you will need fewer customers to hit your revenue target.

Finally, ensure you keep space for any unforeseen expenses in your strategy. This way, you’ll maintain agility in your plan and accommodate any sudden decrease in revenue.

4. Manage daily cash flow.

Source: Twitter

The best way to increase cash flow in your eCommerce business is to be mindful of its daily metrics. This will prevent risk escalation and make your budget more flexible in the long run.

Here are some initiatives you can take to track and manage your daily cash flow.

Staying On Top of Invoices and Payments

When running a growing eCommerce business, keeping track of all the bills becomes difficult. That’s where many companies end up hurting their cash flow.

To stay on top of every payment, accurate bookkeeping is a must. Make sure your data is correct by categorizing every regular invoice based on rentals, fees, EMIs, and taxes.

This way, you can ensure you have enough money to pay the bills and avoid fines. Keeping up with your financial commitments daily will also create a clearer picture of your cash runway.

Creating a Cash Flow Calendar

Cash flow calendars present the ongoing cash flow and forecasts for companies in a daily calendar view based on an analysis of past transactions. This helps you keep track of every cash inflow and daily expenditure and manage it properly.

With a cash flow calendar, you can replace jargon-laden reports and quickly generate a daily summary that is easy to comprehend.

Managing Inventory Levels

Not keeping a well-stocked inventory can make companies lose potential sales.

However, poor inventory control can also lead to excessive stock that is unlikely to sell because of reduced demand. Your money gets tied up in unsold products, gathering dust on shelves, negatively affecting your cash flow.

To tackle these issues and manage your inventory levels effectively, here’s what you can do:

- Invest in an inventory management system to streamline the process.

- Categorize your inventory into three segments: replenished, safety, and obsolete.

- Examine how often you end up using your safety stock. This will give you an idea of your required inventory level.

- Devise a strategy to liquidate dead stock.

- While bulk purchases may seem cost-effective, it’s not the best idea for companies struggling with cash flow.

- Maximize dropshipping.

Monitoring Cash Reserves

Knowing where your money is going is a prerequisite for a healthy cash flow. Here is what you can do:

- Hire a skilled bookkeeper.

- Opt for automation tools for invoicing and tracking payments.

- Invest in analytics to get detailed reports on expenses and cash runway.

Monitoring your business’s daily financial activity will help you align your cash flow forecasting and minimize risks.

How to Understand Financing Options

Morgan Stanley says eCommerce will grow from $3.3 trillion to $5.4 trillion by 2026. Cash flow from revenue and the reduced cost won’t be enough to keep up with this growth. For that, you will need additional capital injection at some point.

To choose the best funding option for your company, here is what you need to know.

1. Typical Financing Options Available to eCommerce Businesses

Asset-Based Lending

Quite popular among eCommerce businesses, this option gives quick cash flow access. The risks are considerably minimum as lenders approve loans based on the collateral asset’s value.

However, one downfall of this type of funding is that the lender could repossess the assets because of non-payment.

Revenue-Based Financing

In this type of financing, the merchant gives lenders a predetermined percentage of their profits as repayments. No credit score requirement is an advantage here.

But in case of slow growth, repayment can take longer.

Bank Loans

Although banks have rigid application requirements, this cash flow is mostly risk-free. Banks get flexible funding and a lower interest rate. However, you won’t get a hefty cash flow through bank loans.

Equity Investors

After hitting a certain growth level, equity financing is a good option for eCommerce businesses. Here, investors provide significant capital for equity in the company. While it does require diluting a portion of the business, the company gets the expertise of the investors in return.

Reaching out to investors can be intimidating, especially if it’s your first time. But there are plenty of great pitch deck examples to take inspiration from.

2. Determining the Best Financing Option for Your Business

If you have a good credit record and need a small and urgent capital injection, applying for a business loan is a good idea.

Equity financing can open up many new doors for companies that have already built a scaling business.

Revenue-based financing is a safe choice for companies with steady revenue and project growth in forecasting.

Asset-heavy eCommerce businesses can collect quick funding by keeping collateral.

Conclusion

While there are significant differences between B2B and B2C eCommerce, cash flow necessity is something they have in common.

In today’s market, there is immense scope for an online business to grow exponentially. But for that to happen, companies must take proper steps to ensure constant cash flow.

Look into your company’s current cash flow to identify areas of improvement. Consider opting for bookkeeping software to keep track of every transaction.

Automate regular client payments. Make sure you keep a balanced inventory based on cash flow forecasting.

Finally, schedule your expenses and generate regular financial reports to detect minor cash flow issues.

With methodical forecasting and regular analysis, your eCommerce business can avoid a drying cash reserve and drive substantial growth.

[ad_2]

Source link