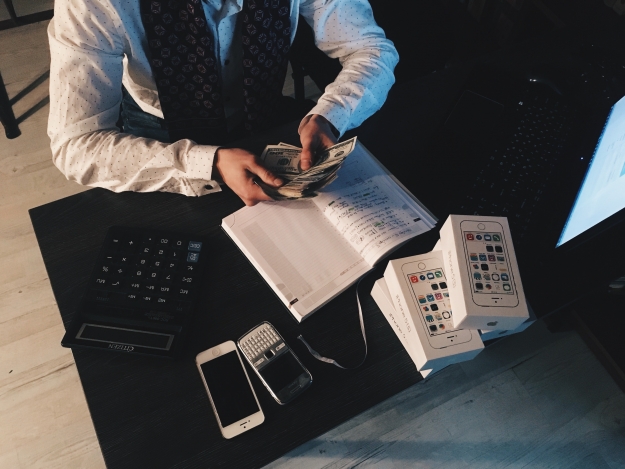

Managing your business’ finances can be difficult, especially on your own. As your business grows, you will likely need to depend on other people to manage your money for you. This page will hope to tell you all of the potential options you have with regard to managing your business’ finances and making the process more efficient and streamlined.

Here are some ways to properly manage your money and improve your overall efficiency.

Employ a Payroll Service

Payroll services can prove to be very helpful. As your business grows and you find yourself employing more people, you may have to start outsourcing payroll to conserve time. By deciding to outsource, you will cut the cost of having to employ full-time payroll personnel, and you will give yourself more time and money to invest in areas of your business that need it the most. A payroll service is a very effective tool that when used properly can streamline your finances.

Hire an Accountant

It is absolutely integral to your business’ longevity and success that you properly manage your accountancy. You can outsource accountants or hire one to check your books monthly. It is very crucial that you keep track of all of your incoming and outgoing money. When you start to see a rise in the business, you can lose track of money, and this is why an accountant is necessary. They will be able to thoroughly examine your books and establish which outgoing payments are unnecessary and help you to find areas of your business that need improvement and areas that don’t.

Financial Projections

Financial projections are a brilliant way for you to keep track of your finances. By looking into the future, you make your business plans and goals much clearer. By creating financial projections, you facilitate a series of plans for your business to adhere to. These plans can be very effective and can ensure that you do not spend money frivolously and only invest in more important areas. Financial projections are a wonderful way to keep on top of your business’ finances. You bring in companies who can create these projections for you if you have no idea how to create one.

Regular Invoices

Writing out invoices every single day can become laborious. It is important, however, that you do not fall behind on your invoices. Your invoices are a very effective way for you to keep track of your finances, and as your business grows, so too will the number of invoices you are required to send out. With invoices growing, it will be easy to forget them, and before you know it, will have neglected to send out dozens. Stay on top of your invoices and send them out as quickly as possible.

Separate Business Accounts

To ensure that your business money does not become tied up with your own, create a separate business account. Business accounts come with many incentives depending on the bank offering them. You should make sure that you have one, even if your business is small. A business account also makes accountancy easier, and you can provide bank statements to your accountant to streamline their job and cut down on time spent doing your books. Business accounts can be taken out at any bank, but you should shop comparatively and find the account with the best package for you.

Save On Business Utilities

You can cut down on costs by reducing your utility bills. It is much easier to manage your business finances that way. It can be easy to lose track and become frivolous with your utilities, but they are notoriously expensive. Internet bills can slowly add up, as can your electricity and gas. To cut down on costs and manage your finances a little easier, reduce your utility usage. Find a better internet provider and a cheaper gas supplier.

Rent Your Office

Consider renting your office or shop front rather than buying. By renting, you save money in the long-run and allow yourself to accumulate more profit. Buying a business front can cost a lot of money and you will find yourself working to accumulate it for the next few years. Rent your office or shop front to cut down on unnecessary costs and to improve your profit margin by tenfold. Renting your office also means you are not tied to a single location and should any situations occur wherein your business needs to move, you will be more flexible.

Now you know a few ways that you can manage your finances and reduce your outgoing costs. Many small business owners go bankrupt within their first year, but by adhering to this guide with your business’ finances, you will have many, many years of longevity, success, and wealth.

The post How to Properly Manage Your Business’ Finances appeared first on Mike Gingerich.

Read more: mikegingerich.com