[ad_1]

Customer research can surprise you. Think a new product feature would be awesome? Your users might hate how complicated it makes things. Guessing about a use case for your product? Consumers might operate it in a totally different way than you imagined.

There’s no doubt about it: The customer-obsessed company wins.

Why you can’t afford to skip customer research

Customer research involves gathering data about your ideal consumers—who they are, what they want, and how you can help them. Companies that conduct frequent research grow up to 70 percent faster and are almost 50 percent more profitable than firms that don’t.

The takeaway? Even conglomerates with million-dollar marketing budgets will fail if they disregard audience research. So, why do so many companies—from startups to enterprises—skimp on it? It comes down to three reasons:

- Fear. Companies aren’t sure how to perform research, so they skip it altogether. They’re afraid they might do it wrong or of what they might find.

- Lack of buy-in. Content marketers often have difficulty getting executive buy-in for customer research. Leadership sees it as an expense rather than an investment and worries if their team is using their (and their customers’) time wisely.

- Lack of resources. Customer research can be a full-time task, especially for enterprise organizations. Not all companies have heavy pennies for product marketing—meaning content marketers are expected to do the humungous task of audience research on their own, along with their other responsibilities.

But Claire Suellentrop, co-founder and COO at Forget The Funnel, says holding back customer research is actually more costly in the long term. “Maybe customer research sounds daunting or time-consuming, but you can’t afford not to take this time,” she said.

“Implementing inefficient, ineffective strategies based on guessing what will work is already wasting time.”

The good news? There are a plethora of ways to do audience research—meaning you can easily eliminate all the guesswork by finding a method that aligns with your resources, budget, and timeline.

5 types of customer research

So, what are the most effective ways to get the research you need? Let’s look at five ways you can do customer research—as well as how you can mix and match them based on your business objectives.

1. Online Customer Reviews

Best for:

- Companies with a tight marketing budget

- Writing killer landing page copy

- Getting unfiltered buyer opinions

Review mining involves reading the online reviews of your and your competitor’s products and analyzing them to guide your marketing. Scour through online reviews to find the perfect swipeable copy, honest buyer opinions, and why customers choose you over competitors.

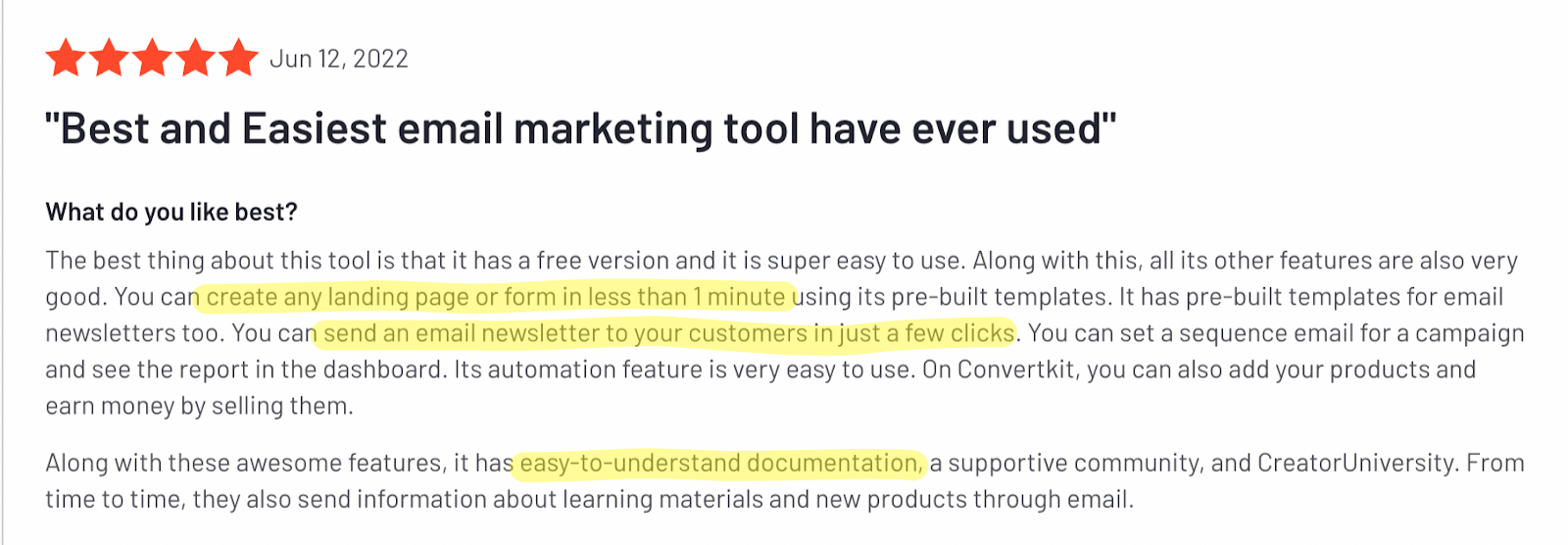

For example, let’s say you’re writing social media posts or landing pages for the email marketing platform, ConvertKit:

You can use review mining to write high-converting, hard-hitting relatable messaging or when you don’t have the budget or resources to conduct one-on-one interviews. Analyze your competitor’s online reviews when you’re launching a new product or when you want to offer features or benefits that your rivals don’t have.

So, where can you find reliable online reviews?

Use social listening tools to your advantage

Use a social listening tool like Hootsuite to track brand mentions online and never miss a public review about your brand. Services like GummySearch also make it ridiculously easy to tap into conversations about your brand on Reddit.

If you want a templated review-mining system to make the process more efficient, consider the Golden Nugget Review Mining System. But remember, the data you get from review mining might be skewed since only the happiest and the most upset buyers write reviews. Consider that bias so you don’t mistake reviews when ascertaining the complete picture.

2. Surveys

Best for:

- Companies with large audiences

- Conducting easy and cost-effective qualitative research

- Getting the answers to specific questions

Customer surveys are one of the most common ways to do customer research, according to Hotjar’s State of Experience Report. The reason? They make it easy to do data collection at scale, and calculating the results is also reasonably straightforward.

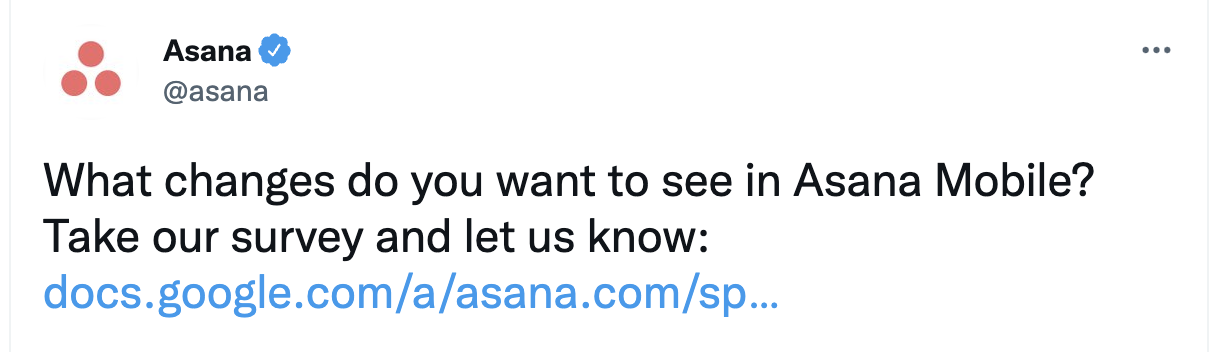

For example, see how the project management tool, Asana, conducted a Google Forms survey to ask users what changes they wanted to see in their mobile app on Twitter.

Be sure you nail your survey design. Too many questions and survey takers will bounce. Too little, and you don’t have enough insight. You might also get misleading answers based on the way you phrase questions. For example, you don’t want to phrase a question like, “Do you think X feature in our product is reducing your stress?” because it’s too suggestive of what you want to hear. Phrase questions in a neutral manner, so you don’t sway opinions. A better phrasing might be, “What do you think of feature X in our product?” It’s open-ended and reduces the room for bias.

Also, avoid double-barreled questions: Ask about only one topic in each question.

3. Internal Resources

Best for:

- Getting insight into existing customers

- Quickly finding what clicks the most with buyers

- Finding patterns in what your audience shares

Dig for gold in your own backyard. It’s crucial to listen to what your sales and customer success teams are telling you—they have insight gold because of their direct, one-on-one access to customers. Ask your CS team about the questions they hear repeatedly to pinpoint your customers’ pain points, areas of confusion, and potential objections.

Like with review mining, you can find swipeable copy instances that let you imbibe customer insights directly into your product messaging.

Tools like Gong and ChorusAI can help you search for keywords from sales calls and get customer insights straight from the horse’s mouth. But be warned: When you use this method, you can’t ask a follow-up question for more clarity. You might need to listen to several calls or analyze many comments, emails, and support tickets to scope patterns.

4. Audience Intelligence (AI) Tools

Best for:

- Gathering insights of your audience

- Analyzing a large audience

- Finding who and what influences your target audience

AI tools tell you what your ideal customers are doing on the web. They share data around engagement, influences, interests, and more. They’re helpful when you want to analyze your or your competitor’s audiences.

The best part? These tools remove the dissonance between what customers say they do versus what they actually do. Your ideal consumer might tell you they regularly read the New York Times or The Atlantic because they’ve recently read a couple of their articles or think it’s what they should be doing. But in reality, they haven’t been a long-time reader.

The disadvantage? How in-depth your customer research goes is dependent on the tool. These software(s) can also be heavy on the pocket and don’t help you build a solid, one-on-one relationship with customers. There are many AI tools in the market, but here are the five you can begin with:

- SparkToro: Find out who your ideal customer follows on social channels, which websites they visit most, and what phrases they most frequently use.

- Audiense: Understand your various customer segments, their personality and needs, and their buying mindsets.

- Brandwatch: Measure customer sentiment, how you stack up to your competitors online, and your brand perception.

- Affogata: Track your industry’s social media trends, real-time customer feedback, and what your competitors are up to.

- StatSocial: Gathering social media insights of your followers, a 360-degree view of your potential buyers, and demographic data.

5. Customer Interviews

Best for:

- Companies investing heavily in customer research

- Gaining in-depth insight into your customers’ buying journey, motivations, pain points, and more

- Forming a genuine connection with customers

We’ve saved the best for last. The literal version of “just talk to your customers!” Why should you invest in one-on-one interviews when there are audience research methods?

Katelyn Bourgoin, customer research expert and founder of Customer Camp, tells us why: “Empathy doesn’t travel through osmosis. Marketers need to talk to customers one to one to truly understand them. When access to customers is restricted, marketers are forced to guess about what works.

And guessing, while it feels good in the moment, will only slow growth in the long run.

One-to-one customer interviews are a goldmine for getting the most accurate insight into your customers’ buying motivations, what job they are trying to get done using your product, and what triggered them to purchase.

Making it a core part of your customer research framework is a no-brainer.

Customer obsession will surprise you and help you win

Audience research is a non-negotiable for growing a business today. Taking periodic pulse checks of customer sentiment is the best way to find what you’re doing right—and what flaws you should improve upon.

Depending upon the size of your organization and what your goals are, you can employ different customer research methods. The crucial bit is truly listening to your customers and getting a deep understanding of the challenges your audience faces. The more you know, the more prepared you will be to serve them best.

Stay informed on the latest content trends, industry insights, and news. Subscribe to The Content Strategist to receive weekly updates.

Image by

sorbetto

[ad_2]

Source link