[ad_1]

Let’s all take a deep breath and confront the truth.

Time is real. The years start coming, and they don’t stop coming.

Generation Z is growing up and reaching financial independence.

And as much as that concept may fill us with existential horror, we need to face the facts.

Gen Z will soon make up a significant portion of the market, and those in the financial services industry who close their eyes to this incoming wave of professionals will be left behind with the scraps.

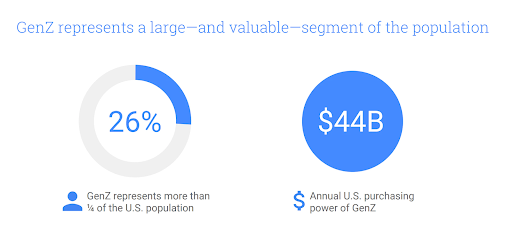

How significant? This significant.

By 2030, Gen Z is expected to make up a third of the workforce, becoming “the engine” of consumer spending. And while Gen Z is often characterized as frivolous and impulsive, money management is at the forefront of their concerns as they enter adulthood.

What does Gen Z value?

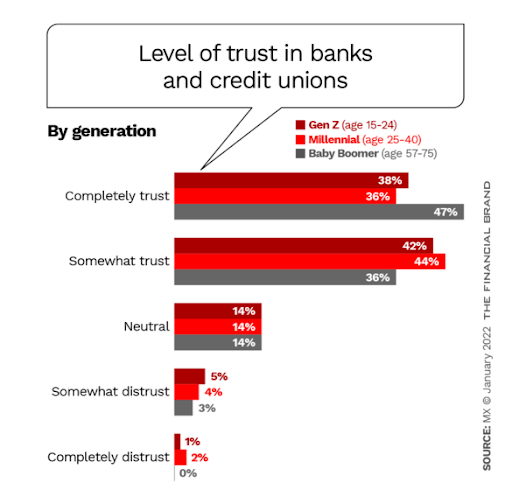

When it comes to financial services, trust is of utmost importance to Gen Z. This generation grew up in a world rocked by economic turmoil and financial scandals, and they are understandably more skeptical of traditional financial institutions than previous generations (with the exception of millennials).

However, Gen Z still prefers legacy banks with established reputations to neobanks and newer fintech companies, signaling that they value the security and stability that many traditional and national banks offer.

Gen Z also isn’t afraid of shopping around. They’re willing to spend the time and effort to compare rates and find the best deals and offerings that meet their needs. However, they are less likely to be swayed by traditional advertising and more likely to be influenced by social media and peer recommendations.

Many members of Gen Z also feel that they are inadequately prepared to make major financial decisions. They want to learn about personal finance, budgeting, and investing, and they appreciate companies offering guidance and resources to help them achieve their financial goals.

Gen Z’s willingness to shop around & openness to learn creates an excellent opportunity for Fintech and SaaS companies to provide them with a range of options to meet their unique needs. These companies can offer various financial services and solutions, including budgeting and savings tools, invoicing apps, investment platforms, and digital payment options, all through user-friendly apps and platforms.

In addition, these companies can provide personalized and tailored services to help Gen Z navigate complex financial decisions, such as choosing the right credit card or loan or making investment decisions that align with their values. This personalized approach can help build trust and loyalty among this generation, who values authenticity and transparency in the companies they do business with.

How do they differ from Millennials?

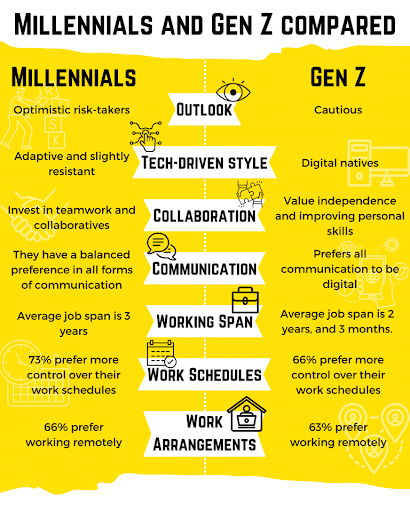

While both Gen Z and millennials have grown up in the shadow of the Great Recession, there are some notable differences in their financial concerns.

For example, Gen Z is just starting to enter the workforce and may be more focused on finding employment and establishing financial stability. They are also more likely to prioritize saving for emergencies, entrepreneurship, and investing for their future, as they have grown up in a world where economic instability and uncertainty have been prevalent.

Millennials, on the other hand, may be more concerned with paying off student debt and achieving financial milestones such as buying a home. They also tend to be more focused on work-life balance and may be willing to accept a lower salary in exchange for more flexible work arrangements, such as hybrid remote work, which affects their attitudes to financial planning significantly.

Marketers should pay attention to the difference in priorities between Gen Z and millennials when developing financial services marketing strategies. For millennials, services that can help them manage their debt and achieve their long-term financial goals may be a priority. On the other hand, Gen Z customers may find services that emphasize financial education and tools for saving and investing more appealing.

5 financial services marketing strategies for Gen Z

You don’t have to reinvent the wheel but do think out of the box a little. Gen Z customers do want to engage with the financial services industry and respond well to companies making an effort to meet them where they are.

1. Get digital

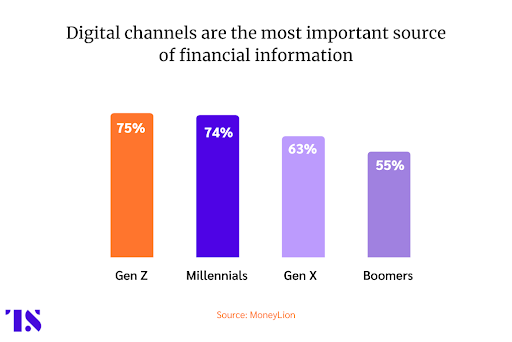

It should come as no surprise that Gen Z, as the first digital natives, prefers to consume content and engage with brands online. This means that digital marketing strategies are a must when it comes to targeting this generation.

This generation has grown up in a world of information overload, and they have developed a keen ability to filter out irrelevant content. This means that your advertising should have clean visuals and concise copy so that your customers can quickly capture the essence of your message. Content creation software tools could make this process extremely easy for you.

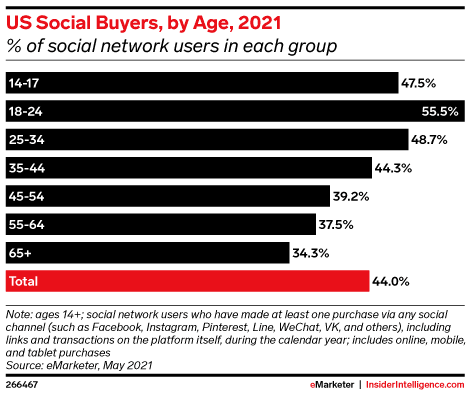

You should also seriously consider social media for financial service marketing. Many members of Gen Z are active on social media platforms, particularly Instagram and TikTok, with many saying that seeing products and services on these platforms contributed to them making a purchase. Video content, in particular, is a powerful way to generate leads. A digital marketing strategy with Gen Z as one of your target markets would not be complete without social media and video marketing strategies.

2. Mobile app

Along the same vein, you should also consider sprucing up your mobile app.

Gen Z customers value convenience and accessibility. A mobile app provides them with a way to manage their finances on the go and in a way that fits their busy lifestyles. Financial institutions should consider offering features such as mobile deposits, budgeting tools, and real-time transaction updates. These features cater to Gen Z’s desire for control over their finances, as well as providing them with a way to simplify their lives.

And it’s not like Gen Z are the only ones who enjoy these features. In fact, research shows that mobile banking usage has been increasing across all age groups in recent years. This means that improving your mobile app can also position your company to compete in a rapidly evolving and digital-centric landscape.

3. Promote financial education

Gen Z-ers are eager to take control of their finances and grow their savings, but most of them feel like their education has not taught them enough about how to manage money.

Therefore, offering and promoting financial education resources, such as articles, videos, and webinars, can be a powerful way to attract and retain Gen Z customers. Do it through your digital channels for your customer’s convenience and integrate it into your marketing strategies.

Gen Z customers value information on fair lending laws, savings strategies, new business and startup regulations, and budgeting. Not only does providing this information empower your customers with financial literacy and confidence in dealing with money, but it also positions your company as a trusted and valuable resource in their financial journeys.

Which brings us to our next point.

4. Build trust and customer loyalty

Trust is the most valuable currency in marketing for any industry, but it is doubly important for financial services marketing.

Building your brand is important to establishing trust with Gen Z customers. Brand awareness activities like social media engagement are a great start, but it’s important to go beyond that. Consider deploying content strategies within your digital marketing campaigns. High-quality content that shows that you understand what your audience is worried about, and that you are worried about those things too, helps to humanize your brand and create an emotional connection with your audience. For example, AI writing tools can help you stay productive and also personalize the content and target specific Gen Z segments to capture their attention better.

But these things can’t just be lip service. Your Gen Z customers aren’t afraid to dig through the receipts. If your actions don’t match your words, they’ll look elsewhere.

Authenticity is the name of the game. This means that being transparent and consistent in your communication and actions is key. So don’t just copy and paraphrase your competitors messaging – get clear on your branding and provide clear information about your services, fees, and policies in plain language.

Along the same vein, responding promptly and respectfully to customer feedback can go a long way in establishing a strong and trustworthy brand. This feedback is also a great source of customer data that you can use to improve your service.

Above all, your Gen Z customers will come to you on the strength of your advertising, but they’ll stay with you for the quality of your service.

This means that you should…

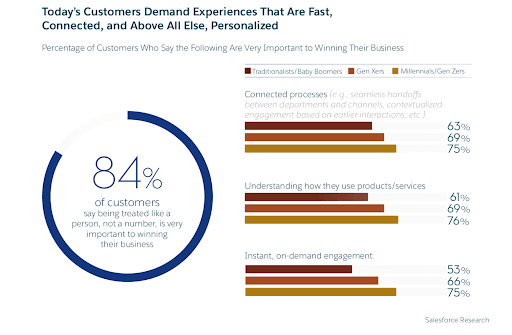

5. Personalize your services

In a world of personalized ads, product recommendations, and social media algorithms, it’s no surprise that Gen Z customers expect personalized financial services too. They want services that cater to their individual needs and goals, and they want to feel like their financial institutions understand them.

In order to personalize your services for Gen Z, you need to understand their unique needs and preferences. For example, many Gen Z-ers have grown up in a sharing economy and value access over ownership. They may prefer services that allow them to rent or share goods and services rather than buy them outright.

To truly personalize your services, you can leverage data and analytics to better understand where your customers are coming from. For example, you might ask your new customers to do a quick quiz. By using this information, you can offer tailored recommendations and solutions that meet their particular financial goals, ultimately building stronger relationships with your Gen Z customers.

The kids are alright. Really.

It may be intimidating, but as the financial landscape continues to evolve rapidly, it’s crucial for companies to keep up with the latest trends and technologies to meet the needs of their customers. In order to successfully market to Gen Z, financial services companies need to stop fearing non-traditional marketing approaches and embrace the oncoming change.

This might mean taking a dip into new social media platforms or having a look at what personalized experiences AI tech and chatbots can offer your customers. But at the end of the day, it isn’t like the thoughts and motivations of Gen Z are entirely alien to us. They want stability, security, and quality service, just like everyone else. And as marketers, staying agile and responding to the needs of the customer is the same job as ever.

We’ve innovated in response to massive changes in the consumer market. We will continue to innovate as the market keeps changing.

We might just have to drink a bit more coffee to help us keep up with the young’uns.

[ad_2]

Source link