[ad_1]

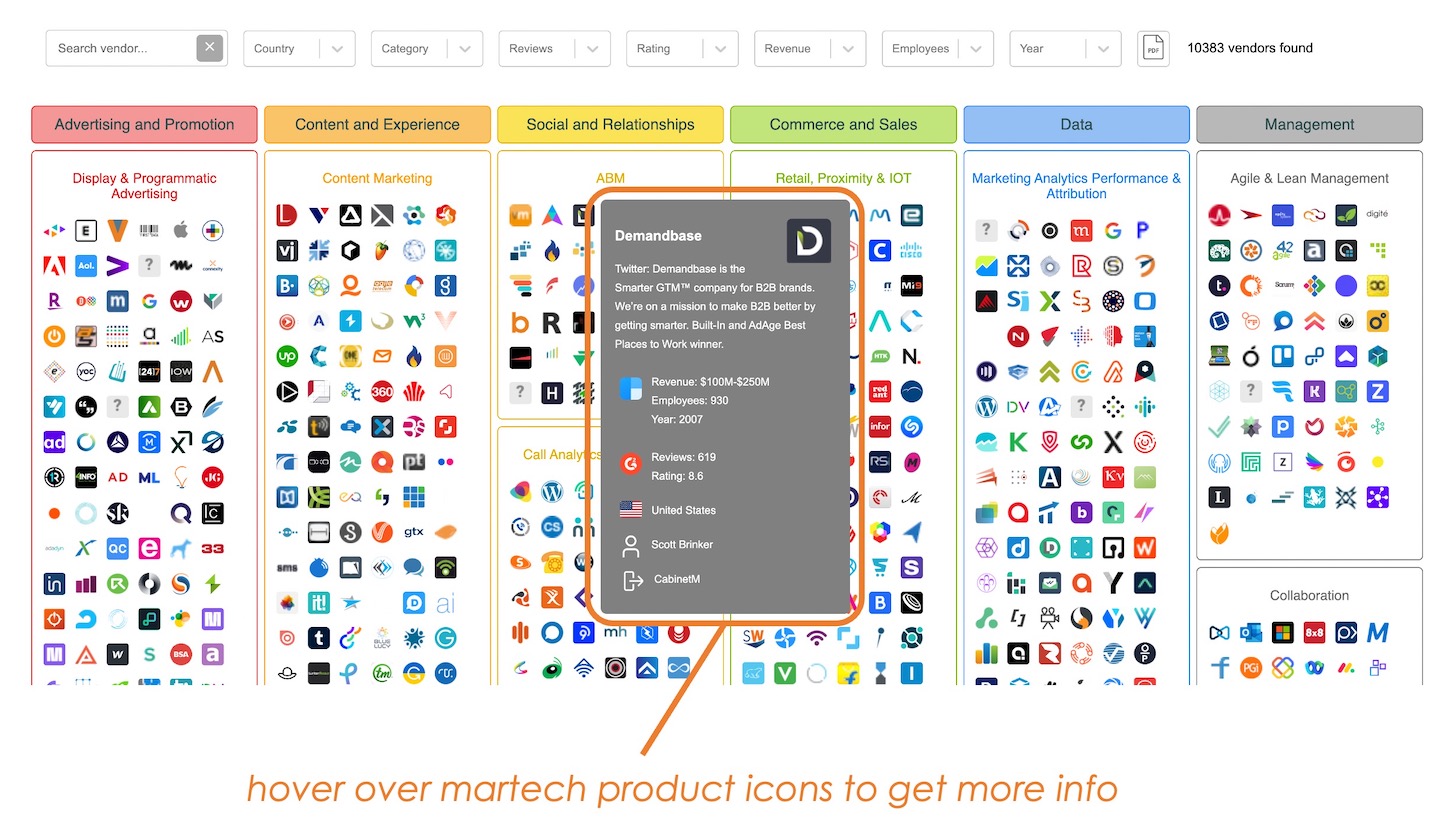

In today’s virtual occasion Martech for 2023: The (Definitely) Major Photo — comprehensive movie will be shared tomorrow — Frans Riemersma and I produced a key update to the interactive martech landscape on martechmap.com.

We know: the martech landscape is overwhelming. In our most up-to-date update to the databases, even right after removing a amount of alternatives that have been possibly acquired or shut down in excess of the past 6 months, we finished up with extra than 10,000 goods represented. When you move back again and glance at them from a bird’s-eye look at, it’s a intriguing photograph. But it is a haystack of needles. Not quick to uncover points in it.

But these days, it’s just gotten a minimal easier…

Many thanks to two new facts partnerships with G2 and Clearbit — thank you, both equally! — we were being capable to enrich our databases of martech remedies with a lot more data. Clearbit offered knowledge about estimated profits, staff size, and founding day for quite a few of these corporations. G2 offered info about the ratings for many of these goods.

Frans and I have extra these filters to martechmap.com, so you can now look for and filter by any of the subsequent fields and combinations:

- Search phrases in website meta-description and Twitter profile bio

- Nation in which the organization is headquartered

- Classification in which is the solution is categorised

- Amount of critiques obtained on G2

- Regular ranking on G2

- Estimated earnings

- Believed variety of staff members

- 12 months established

Disclaimer: we really don’t have total coverage in between our dataset, Clearbit’s, and G2’s, so the final results from working with these filters is incomplete. We’ll be functioning on filling these gaps, as nicely as tweaking the performance and ironing out any bugs. But ideally it is good adequate to be intriguing and considerably more handy.

When you hover above any of the icon logos — we harvested the favicons of these martech vendors’ web-sites — a card will appear with more aspects, together with the Clearbit and G2 fields where we have them.

Is there a martech products you know that is missing or needs its group up-to-date? Add your strategies in this article.

Martech Product or service Rankings: Patterns & Hypotheses

Frans and I ran a few analyses on this knowledge in combination and discovered various exciting styles.

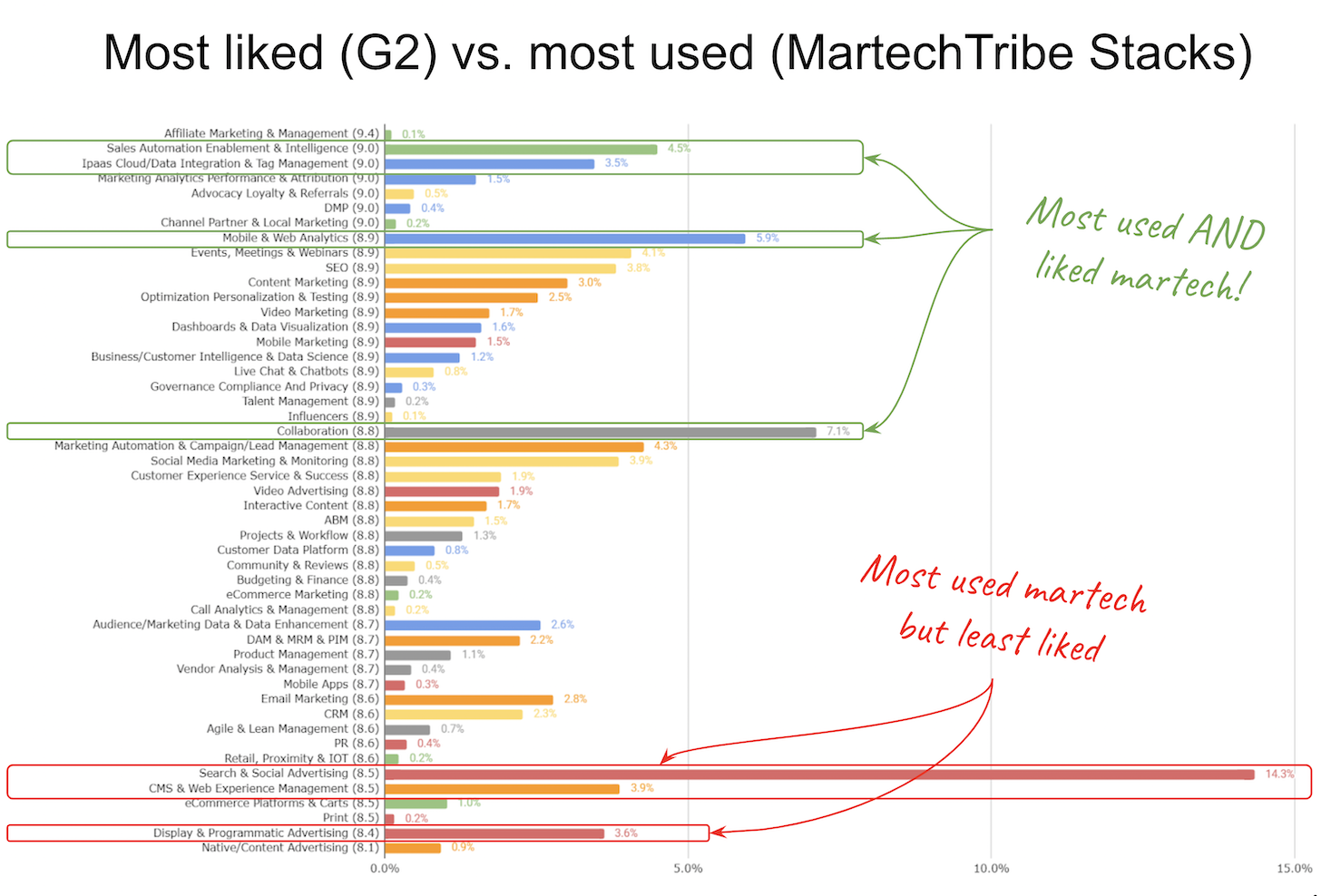

Very first, we established a bar chart of all the martech groups and the frequency by which goods in these groups look in the databases of martech stacks that Frans has gathered more than the earlier many several years. We then ordered the bar chart by the common G2 scores of goods in people groups from optimum to lowest, top to base.

The consequence earlier mentioned shows that salestech, iPaaS, cell & web analytics, and collaboration resources have been both equally hugely rated and commonly included in stacks. Approximately talking, they’re the most used and most favored martech.

In contrast, look for & social advertising, CMS & world-wide-web knowledge management, and exhibit & programmatic advertising and marketing were being regularly provided in stacks — but not specially properly-favored, at least on ordinary.

Of system, CMS and adtech are also two of the oldest classes in martech. Which led us to get a seem at this distribution:

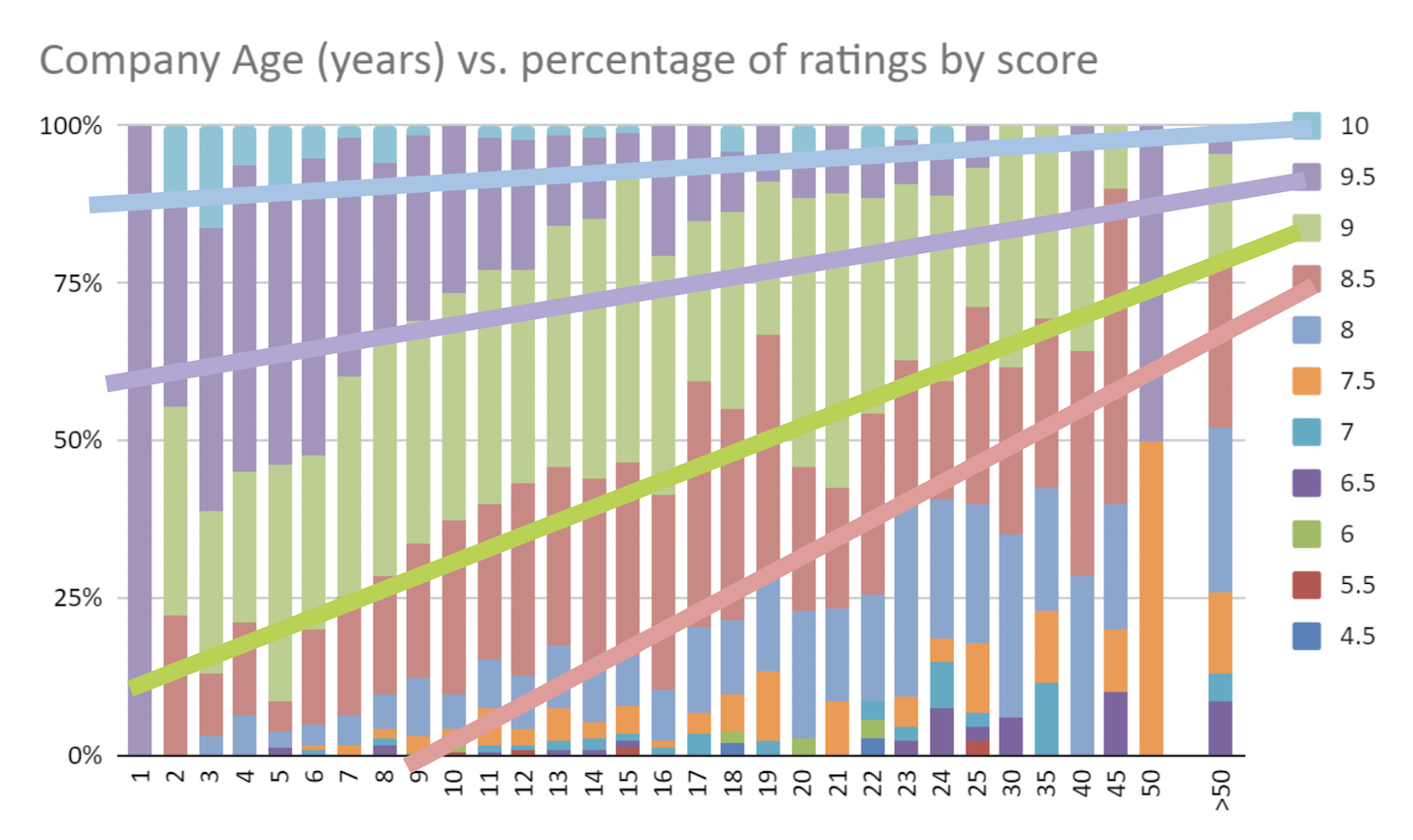

This exhibits the share of distinct G2 ratings, substantial to lower, on the y-axis, compared against the age in many years of the suppliers on the x-axis. More recent vendors on the remaining to more mature vendors on the ideal. (Of course, there are some martech businesses that have been about 50+ yrs.)

There’s a extremely apparent pattern here: more recent martech organizations have a tendency to have increased G2 ratings than older kinds.

A hypothesis that would seem realistic to us: this is proof of new disruptors difficult the “old guard” in current classes. Martech merchandise that have been close to a long time might have difficulty retaining up with the newest developments and purchaser anticipations in their category. Their ratings, on common, slide downward above time.

New martech startups see this as an chance and start challenger products in those types — and generally do properly ample to earn improved ratings.

It’s an clarification for why the martech landscape as a full has defied consolidation. Sure, solutions do get “consolidated” into much larger corporations around time. But then individuals more substantial, more mature, consolidated providers get challenged by new startups that greater provide marketers on one or extra proportions — features, selling price, user knowledge, and many others.

Even more investigation in the chart earlier mentioned, comparing G2 ratings by typical dimensions of organization in variety of staff members — which is frequently correlated with a company’s age — further more validates this speculation. The scaled-down the martech vendor, the higher their ratings (on average).

It’s interesting to observe that in this chart merchandise in the Indigenous/Articles Promotion category have the worst normal ratings. An chance for disruption?

In the meantime, products in the Affiliate Marketing & Administration classification have the ideal normal ratings.

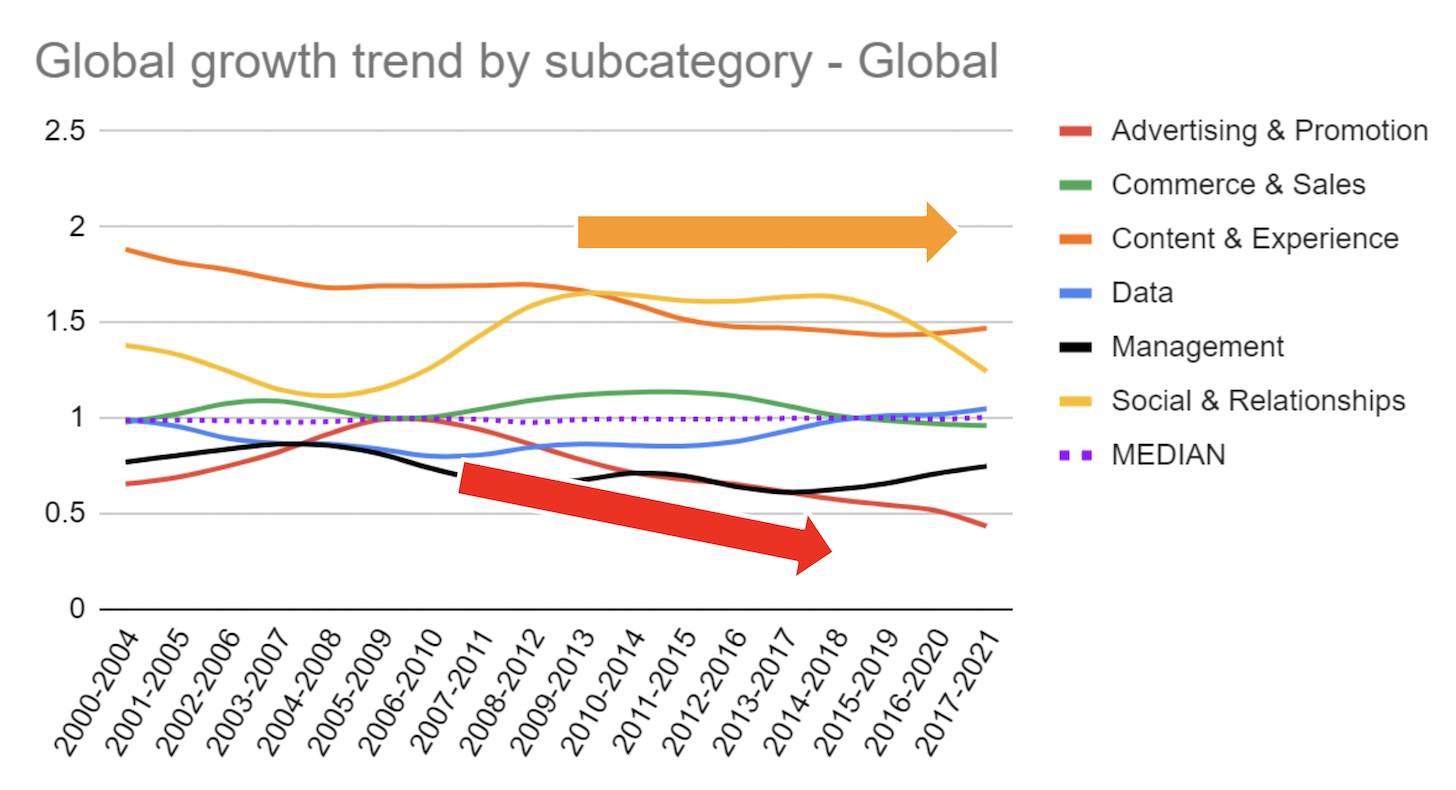

One particular previous investigation to share with you: progress in the amount of new martech distributors established in various categories over time:

We normalized them relative to the total median number of martech startups each individual calendar year, to highlight which groups are inclined to have extra or much less new entrants.

The groups of Content & Knowledge and Social & Interactions groups have consistently experienced the most new startups. It tends to make perception. Individuals are the groups where the advertising and marketing ecosystem and buyer anticipations have had the most changes above the earlier decade. There tends to be a good deal of option for differentiation there.

On the other hand, Promotion & Advertising classes have had less and fewer new startups since 2010. Relative advancement of new entrants in adtech has been steadily declining for a 10 years.

But offered the rather reduced rankings that have amassed in adtech types, probably this is a house that is ripe for new disruption?

In addition to Clearbit and G2, whom we are grateful for remaining “data sponsors” in this task, I want to thank SAS, Uptempo, and Calendly, who sponsored today’s virtual occasion, giving us monetary methods to aid our study these kinds of as this. I also want to thank Goldcast for getting our virtual celebration platform sponsor. As these companies support us, I hope you are going to consider supporting them in return.

Keep tuned for the recording of our presentation to be posted tomorrow.

[ad_2]

Supply url